Gather AI’s Drone Vision Software Can Be Counted on for Warehouse Inventory

Gather AI’s co-founders are world-class robotics experts whose drone software allows customers to overcome the most common warehouse inventory challenges.

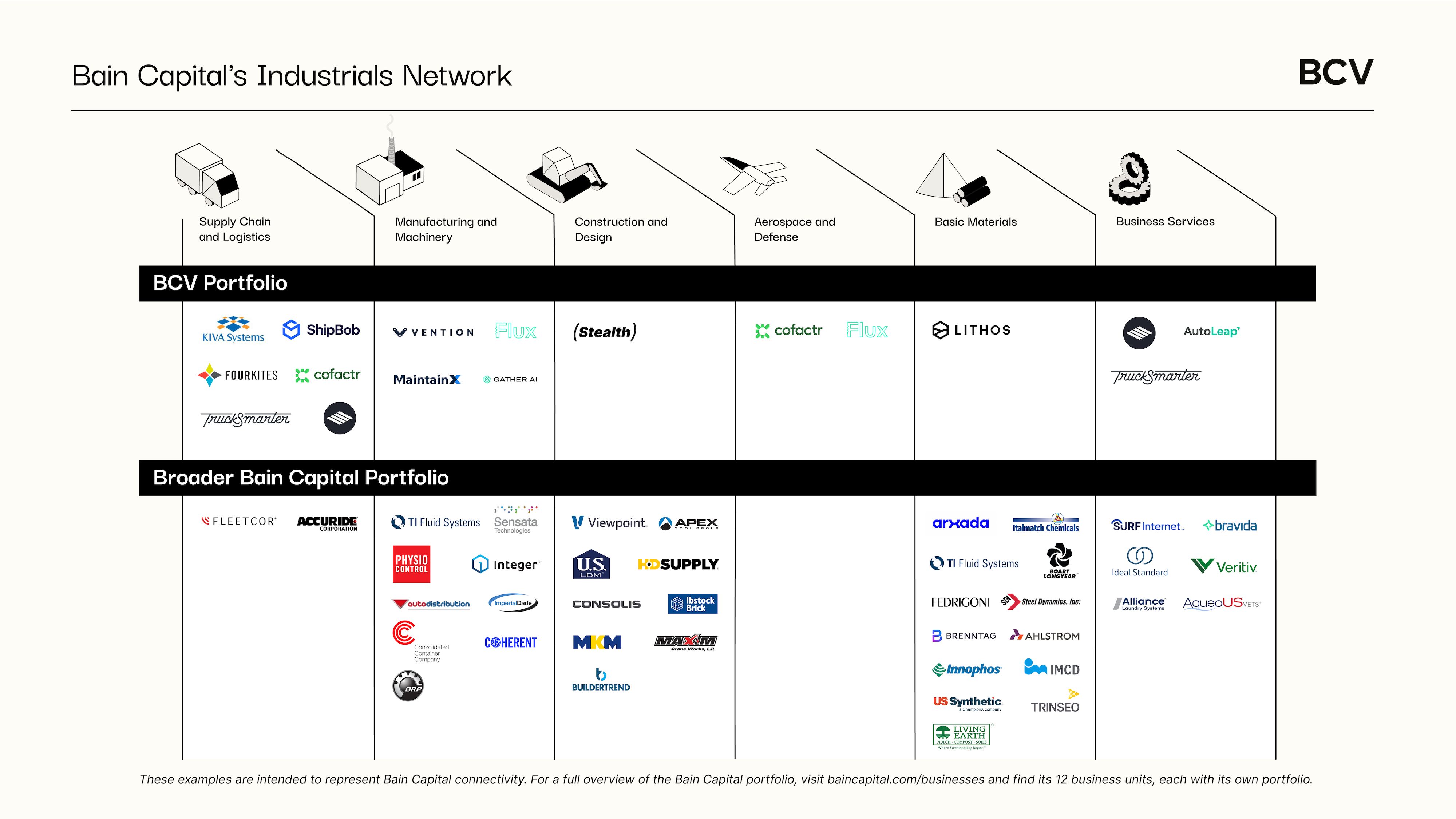

We are building on 20 years of investing in the industrial space, and are tapping the full potential of the broader Bain Capital network.

From freight yards, to warehouses, construction sites, factory floors and machine shops, our economy is pulsing with the energy and creativity of an Industrial Renaissance.

Transformation in the physical world is accelerating and this new era is ushered in by several tailwinds:

We see these changes firsthand throughout the Bain Capital family. Across Bain Capital Ventures and our sister funds at Bain Capital we manage a large portfolio of companies and maintain a trusted network of relevant partners in the ecosystem. As part of this broader family, we have the unique opportunity to go beyond the role of investors. This connected approach allows us to address opportunities from all sides of the ecosystem — from founders and funders to customers and incumbents, we help drive innovation across all stakeholders.

When you leave Silicon Valley and the world of single-digit billions in software revenue, you land among untapped opportunities to transform trillions of dollars in economic activity. We have been blown away by the quality of founders we have met over the past few years attacking this space with a range of approaches. These founders are pursuing a number of opportunities and business models, many of which are highlighted below:

In large verticals, there is an opportunity to build integrated software and delivery networks that are purpose-built for a specific industry. Vertically integrating is challenging, but by building an end-to-end solution, companies can offer a comprehensive, and by extension a stickier, solution to their customers. And in doing so, they’re able to capture more value in the ecosystem and differentiate themselves from competitors, both legacy and next-gen.

ShipBob, for example, offers a full-stack of logistics solutions for e-commerce — one that outsources the entire fulfillment function for its brands.

Cofactr is doing the same for the electronics supply chain by offering a software platform that manages parts, a marketplace to source and procure those components and the underlying logistics services to safely deliver them.

We are seeing founders build similar solutions in other verticals like healthcare (Verse Medical), lumber (The Lumber Manufactory) and dairy (Milk Moovement), and suspect there will be continued demand in other heavily regulated industries, such as pharma and chemicals.

While there has been a wave of cloud-based tools attacking legacy software with more collaborative solutions, they have mostly been focused on tech end markets. Building and scaling in the built world requires its own solutions.

Despite this renaissance of new hardware startups, the foundational software tooling for designing and building hardware has not kept up. The majority of tools in areas such as computer-aided design (CAD), electrical computer-aided design/electronic design automation (eCAD/EDA) and product lifecycle management (PLM) were developed in the 1980s and ‘90s without the benefit of native cloud support, collaboration or multi-party workflows.

We believe this current wave of hardware innovation will drive the creation of modern software tooling for hardware, led by companies like Flux (printed circuit board [PCB] design), Stell (requirements software for aerospace and defense) and Dirac (work instructions).

The physical world relies on thousands of SMBs (carriers, freight forwarders, warehouse operators, waste management managers, chemical plant operators, auto repair shop owners, etc.) that need software to more effectively operate. The current wave of vertical SaaS companies has capitalized on digitization across the buyer and end user, improved foundational technologies and increasingly accessible data.

For example, in the freight industry, truck drivers require modern solutions to help them book loads, manage their cash flow, pay for fuel and manage safety and compliance — in other words, they need classic vertical SaaS plus embedded payments. Companies like TruckSmarter are solving these challenges for truck drivers, offering a free load board as a wedge to provide a broader array of software and services like fuel discounts, factoring and banking. Similarly, companies like Pallet, are leveraging modern, extensible software with no-code editors and built in AI in order to streamline the historically fragmented transportation management space (TMS).

Many startups are tackling key sectors throughout the physical world with a similar approach, including construction (Adaptive), agriculture (Seso), scrap yards (Rematter) and business services (Rundoo with paint and hardware). Most players in the space have also explored the opportunity to embed fintech into their product to provide a greater value proposition to customers.

Geopolitical factors, labor shortages and economic uncertainty have presented more challenges and forced an adoption of automation throughout the built world over the last year. As a result, many companies have looked into new solutions that optimize and automate operations.

Though it started as a necessity, companies have recognized that adopting automation allows them to improve time to market and supply chain resiliency as a competitive advantage.

In manufacturing, for example, solutions like Vention democratize automation and enable speed and rapid innovation on the modern factory floor for some of the most innovative companies across the built world — including Amazon, Blue Origin, Boeing and Toro.

Another important dimension of manufacturing automation is anticipating issues before they exist, rather than responding to them retroactively, and that’s why we’re seeing the industrial world migrating from reactive to preventative maintenance. The “sensorification” of industrial environments combined with software like MaintainX, Axion Ray and Lumafield, enables this shift.

There are many applications for industrial automation beyond manufacturing, where new solutions can help automate repetitive tasks. In logistics, for example, carriers spend a significant portion of their day at a dock waiting for forklift operators to load and unload their trailers. Companies like Slip Robotics can help streamline this task down to five minutes. In construction, an additional half a million new workers in 2024 are needed to match demand, creating more opportunities for automation across the sector.

In 2004, when BCV invested in Kiva Systems (now Amazon Robotics), most entrepreneurs were building software for tech end markets. Mick Mountz, Kiva’s founder, was seemingly a lone entrepreneur tackling the physical world, building a hardware/software company with mobile shelving transported by autonomous robots, tripling the output of a typical e-commerce worker.

Kiva was focused on “turning atoms into bits,” and many of the concepts utilized in traditional data storage — caching, pre-fetching, storage hierarchy — were core to the Kiva system. This wasn’t simply a robotics company; this was a great example of a “systems company,” where the core was software and the fleet of robots instead played the role of necessary enablers. The depth of software allowed Kiva to maintain tech margins and is why eight years later Amazon paid a premium software revenue multiple when it decided to make Kiva its second-largest tech acquisition at the time.

Over the last two decades, our focus across the industrial base has expanded in scope. We’ve partnered with founders and companies solving the hardest challenges in the built world, including supply chain and logistics, manufacturing and machinery, construction, aerospace and defense, basic materials and business services. Though ranging in stage and sector, we’ve distilled our learnings from them into three key insights.

While many of our investments have hardware or other physical components, the core innovation is software.

This is as true for Vention as it was for Kiva. Software is core to Vention’s platform, which a factory engineer can use to intelligently design complex automation solutions in 3D. Its software is the foundation of its automation suite, which allows engineers to simulate, via a digital twin, the actions of a robotic solution, monitor performance and activity, and send updates remotely.

Gather AI’s inventory visibility solutions operate via drones, but the company utilizes off-the-shelf drones, with advanced computer vision software as the core innovation.

ShipBob’s core solution is built on a proprietary stack of software that tracks inventory from factory door to the end consumer. With a single pane of glass, ShipBob can optimize the density of warehouses, placement of inventory, selection of last mile carrier and timing for inventory replenishment. This platform provides a cost-effective two-day fulfillment solution to small and medium e-commerce brands.

Point solutions can be effective building blocks when selling traditional enterprise software. The benefit of a point solution is that it solves a key pain point and is easy to purchase and implement thanks to open APIs, pre-built integrations and limited business process change.

In the physical world, point solutions are a much tougher value proposition. The software stacks inside these companies in healthcare, manufacturing or industrials aren’t standardized and therefore the data formats and integrations can be messy and time intensive.

Venture-scale companies in the physical world go beyond point offerings and embrace the ambition of offering a system or platform. Many people remember Kiva’s orange robots, but they miss the reality that “Kiva” was an entire operating system: They sold the robots, the shelving itself, the warehouse planning software, and the machine learning technology to optimize how far or close goods are at any given time of day and year. Do you want a robot with a short turn radius and long battery life? Or do you want the vision of a network of warehouses that organize themselves?

Vention is known for its trademark blue T-slots and aluminum extrusions, but what it really solves for customers is reliable access to next-day industrial machines and automation, designed from the ground up to meet their emerging needs. These highly customizable machines can be networked together to solve complete end-to-end processes for a given manufacturing line.

The key to Kiva’s success was its ability to sell at the highest levels of its retailer customers. Kiva’s founder, Mick, regularly met with the executives and board of directors of many of his early customers and positioned Kiva’s solution as the key enabler to launching a viable D2C e-commerce business, instead of trying to sell a robot to the warehouse manager.

Similarly, ShipBob does not position itself as a collection of warehouses with people putting things in boxes. Rather, ShipBob is an invaluable partner to the fastest-growing D2C brands by demonstrating how fast shipping, customized packaging, thoughtful inserts and other capabilities will differentiate their products and build brand loyalty.

Through these strategies, Kiva and ShipBob avoided getting stuck inside innovation groups or endless procurement RFPs at large companies. These teams are well-meaning but typically have small budgets and little to no influence on what the line-of-business cares about.

From our earliest days investing in Kiva all the way to today, as we watch companies like ShipBob, FourKites and MaintainX scale, we believe that software is at its most impactful when it touches the physical world.

As we look to the next decade, our resolve is unchanged: to find, fund and foster the best talent building software for industrial sectors. We are actively seeking founders who are building in these industries and would love to hear from you. Reach out to us at zcole@baincapital.com and ajay@baincapital.com.

Gather AI’s co-founders are world-class robotics experts whose drone software allows customers to overcome the most common warehouse inventory challenges.

We explore the opportunities startups can take advantage of to revolutionize freight logistics through generative artificial intelligence.

We are highlighting the most promising early stage vertical SaaS companies based in the U.S., across a variety of industries.