Norm Ai Is Using AI to Clean Up the ‘Sludge’ of Regulatory Compliance

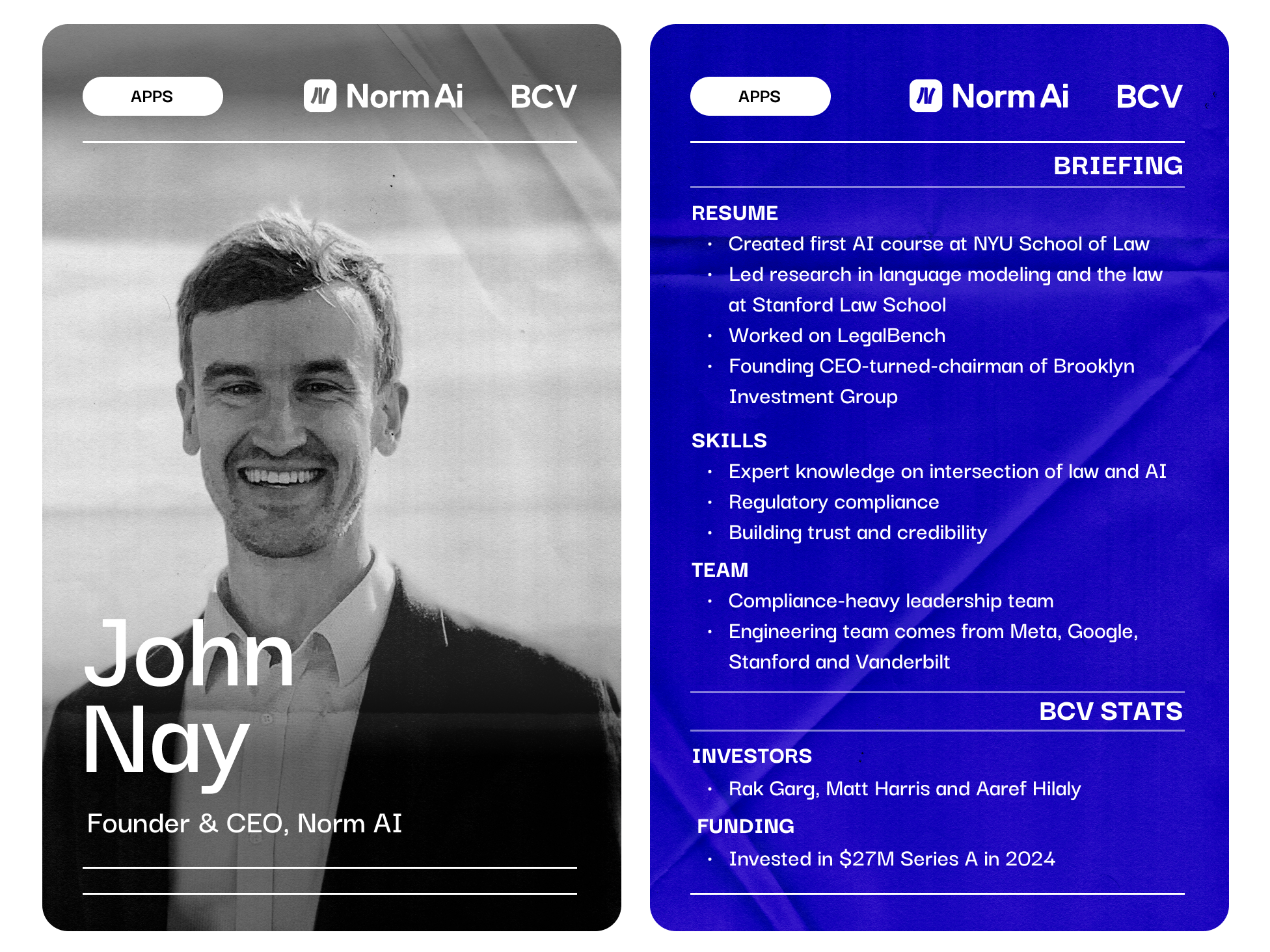

John Nay, a founder at the intersection of AI and law, built Norm Ai as a solution to aid compliance officers in highly regulated industries.

Regulatory compliance costs are what John Nay, founder and CEO of Norm Ai, calls a “sludge problem.” Regulations grow increasingly complex, layering upon each other in unpredictable ways. In the past 50 years, the number of restrictions imposed by U.S. regulations has more than doubled.

At the same time, regulatory teams are overburdened and noncompliance is an existential risk. The result is that companies spend more on third-party service providers while not actually improving their overall adherence to regulations. Even the most well-resourced companies struggle to follow the rules without reducing their speed of execution.

Like software development, regulatory compliance — involving many semi-structured, repetitive tasks — is well-suited to AI agent-based automation. Most existing software for compliance officers is focused on workflow tracking and reporting. Norm could be the first to do workflow execution, enabling compliance teams and business units to move faster.

“During my grad studies, I found that language models captured legal concepts in very simple ways, but roughly three years ago the frontier of LLMs showed signs of ‘understanding’ nuanced legal standards,” John told us. “We are now at an inflection point in these AI capabilities that, when properly harnessed, unlock massive improvements in regulatory compliance workflows across the economy.”

John founded Norm in 2023 and quickly assembled an impressive team to build the first AI platform that converts and then executes regulation as code. “Many of the regulations companies must comply with are well-intentioned, and if implemented efficiently are a net positive for society,” he said. “Norm is the attempt to allow the world to automate the parts of regulatory compliance that unlock the ability to regulate effectively, but also efficiently, at lower cost to society.”

The biggest headwind for businesses working in highly regulated industries is the buildup of that “sludge,” as John calls it, slowing them down and increasing risk. The combination of John’s deep expertise and his passion for tackling this challenge head on is what drove BCV to join him and the Norm team on their mission to change regulatory compliance for the better, and that’s why we invested in the $27 million Series A with Coatue, Blackstone, Citi, New York Life, TIAA and former Blackstone president Tony James.

Meet the Founder: A rare talent at the intersection of AI and law

John’s understanding of language modeling and appreciation of legal systems makes him uniquely suited to tackle the challenges of regulation adherence. He’s dedicated much of his post-PhD career to researching the codification of legal systems into AI models, having created the first AI course at the NYU School of Law and conducted research in language modeling at Stanford Law School’s Center for Legal Informatics.

He helped author the popular LegalBench benchmark, a collaborative, ongoing open science effort to evaluate legal reasoning in LLMs, and founded Brooklyn Investment Group, an AI company with an SEC registered investment adviser.

For Norm, John recruited an impressive founding team with strong depth — like COO Patrick Vergara, who has a law degree from Stanford and previously led product at Alkymi, a document intelligence company focused on financial services companies. Norm’s engineering team comes from Google, Meta, Stanford, Vanderbilt, the federal government and more.

How It Works: Applying generative AI to regulatory compliance

Norm has built the first regulatory AI platform automating regulatory tasks for chief compliance officers.

Norm’s team of AI engineers and legal engineers have developed a proprietary language to represent government regulations and corporate policies as decision trees. LLM-driven AI agents efficiently conduct robust compliance analyses as they traverse the tree.

Users engage with Norm through its workflow software. Compliance and business users upload artifacts for review, after which Norm autonomously produces accurate findings by executing modules against the artifact for a specific regulation. As one example of a module: When significant claims are made, Norm automatically finds and keeps track of the evidence to substantiate those claims, making it easier for teams to reduce risk.

Norm also continuously updates its decision graph for every regulation it monitors, helping teams stay updated with regulatory changes and amendments.

Using Norm’s collaboration features, users can tag each other, comment and view historical decisions. This allows the platform to become a system of record where compliance teams collaborate, pulling them out of emails and centralizing relevant conversations. When used this way, Norm becomes a bridge for organizations to self-serve compliance, accelerating business teams.

“Norm enables businesses to complete comprehensive compliance analyses nearly instantaneously, empowering humans to understand the basis for a determination and how to specifically improve work output to make it compliant,” John said. “Businesses can move faster, do more and be more compliant, all at the same time.”

Companies use Norm for critical regulatory assessments. For example, insurance companies, investment firms and other financial institutions accelerate the publication of highly regulated content while freeing up bandwidth for other tasks that require more human intervention. By automatically providing clear, actionable explanations for findings across all regulatory parameters, regulation-compliant content that used to take compliance professionals days to evaluate now only takes minutes.

What’s Next: More sophisticated AI-enabled regulatory compliance, less human intervention

According to John, the possibilities of regulatory AI can be broken down to three levels, with less human intervention needed as the technology improves:

- Level one: Regulatory AI automates determining what is not in compliance with a regulation. Humans then determine what to do to make things more compliant and then do those things.

- Level two: Regulatory AI automates determining what is not in compliance and creates a list of actions that can be taken to be more compliant and then humans do those things.

- Level three: Regulatory AI automates determining what is not compliant, creates a list of actions that can be taken to become more compliant and then does those things.

Norm customers will gradually experience greater degrees of autonomy in their compliance workflows. Over time, the company will target additional regulatory adherence workflows in financial services, insurance, healthcare, energy and other industries.

“Soon,” John said, “interacting with AI agents of all types will just be part of our daily lives, which will present enormous governance challenges.”

In this world, a Norm AI agent could be responsible for ensuring that the actions of other AI agents are adhering to public regulatory and corporate policy guidance.

“This enables the deployment of other AI agents in high-stakes workflows where human compliance employees are inevitably too slow to review the work outputs,” John said. “Because public policies reflect our society’s collective will, Norm will help solve the societal-AI alignment problem through this oversight.

Norm Ai is focused on bringing its platform to more Fortune 100 customers, and it’s expanding its software, AI and legal engineering teams, along with its sales team and others. You can find open roles on the Norm Ai Careers site.

Related Insights

MagicSchool’s AI-Powered Software Is Ushering in the Future of K-12 Teaching

MagicSchool founder Adeel Khan is a former teacher and principal whose AI platform is saving teachers time, fighting burnout, and helping schools build responsible AI experiences for students.

These Are 2024’s Top 50 Vertical SaaS Startups

This year's selection honors 50 new early-stage startups building industry-specific software across a variety of verticals.