Only Up From Here: 2024’s State of Fintech and the Hero’s Journey

We’re at the scary part of “the hero’s journey” in fintech, with a bottom for funding and a BaaS crisis, but we’re about to enter a new, exciting stage.

At BCV, we've seen the role of the CFO evolve since our founding in 2000.

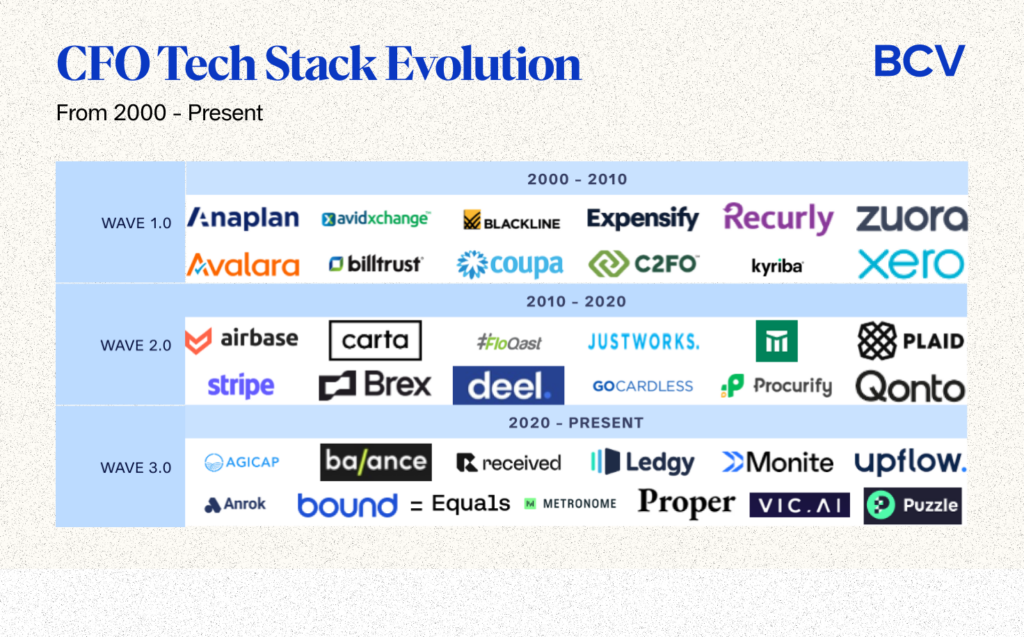

At Bain Capital Ventures, we’ve seen the role of the CFO evolve since our founding in 2000. In recent years, we have identified a third transition emerging, which cements the CFO’s core competencies as table stakes and emphasizes the need for new capabilities. Each wave can be characterized as follows:

This Third Wave can be evidenced by a 2022 study by executive search firm Crist|Kolder Associates, which found that CFOs are increasingly credentialed with MBAs rather than CPAs, where the percentage of CFOs with MBAs have increased from 45.8% in 2017 to 51.5% in 2022, while those with CPAs declined slightly from 35.1% to 34.9% in the same period.

While credentialing is a lagging indicator, we can look to another finding in the study as a leading indicator: more CFOs are being promoted to CEOs over time, with the percentage of CEOs rising through the CFO role increasing from 5.6% in 2012 to 8.1% in 2022. This implies that CFOs increasingly possess the cross-functional skillsets and dynamic characteristics that qualify them for the CEO role. What does this mean for CFO tools?

Pre-2000, CFOs mostly relied on ERPs as their source of truth and core workflow tool. However, ERP platforms are still only mid-leap in modernizing and are saddled with legacy on-prem systems and version sprawl. As a result, Wave 1.0 of the CFO stack emerged to “unbundle” the ERP with cloud-based solutions, similar to what we initially saw happen in the early days of fintech, which unbundled banks, or general workflow software, which unbundled Google and Microsoft. The core functions were disaggregated to create an ecosystem of best-of-breed players thriving off the sprawl of monolithic ERP systems.

Wave 2.0 tools built in additional analytics and automation capabilities to free up finance teams’ time to focus on more strategic and multi-dimensional activities. Notably, these tools did not require an army of people to implement and operate. Additionally, during this time, fintech infrastructure tools also sprung up to enable more seamless payments (mostly payment acceptance, but also payouts).

The Wave 2.0 tools have, on one hand, saved finance teams time and money, but they’ve also surfaced a whole new set of challenges, including an unwieldy amount of tools to manage, difficult data portability, and lack of real-time visibility. While COVID-19 sped up cloud adoption curves, it also exposed these challenges, and has ushered in a new CFO persona.

The finance leaders of this third wave need a different set of tools to be successful and effective. We’re excited about the companies building tools to address these needs:

Finance teams are increasingly opting for consolidation rather than multiple best-of-breed solutions; there’s a re-bundling occurring. In fact, a recent survey conducted by our later-stage Bain Capital colleagues found that 70-80% of respondents (n = 119) would be interested in switching to a single vendor solution that provided an integrated offering of treasury management with other CFO software functions, such as FP&A, financial close, external reporting, A/R, A/P, tax accounting, and procurement. We’ve seen companies like Agicap expanding from cash flow visibility to forecasting, invoice management, and enabling collections / payouts, which entirely replaces the need to hire a CFO for some small business operator-owners.

Furthermore, we’ve also seen the proliferation of embedded payments—Billtrust, an early BCV investment, was one of the first in this category to embed a payment link within their billing solution, taking the role of merchant-acquirer given they had the supplier relationships and were best equipped to manage card payments for their customers. It’s generally difficult to remain in hyper-growth for long with a subscription revenue model, so embedding financial services helps drive additional revenue capture with minimal customer acquisition cost.

However, not every expansion path works because each CFO workflow is driven by regulatory and/or compliance procedures that can make the workflows distinct and complex. For example, we have yet to see an A/P automation player successfully expand into invoicing or A/R automation. Instead, it’s a more logical product strategy to go from expense management –> A/P automation –> procurement –> forecasting –> working capital loans, or a similar path that builds on the data a CFO tool has already acquired.

We spoke with one enterprise CFO who uses two different methodologies to forecast.

1) The first is a bottoms up approach, where the finance team leverages internal information such as closed financials, compensation data, and pipeline leads, and then requests input from each functional group on their hiring plans and growth targets to inform budgets.

2) The second is conducted by an in-house economist who leverages macroeconomic data to build forecast models. What this CFO found was that methodology #2 produced more accurate forecasts 9/10 times! This begs the question whether finance teams can better eliminate biases in input data and whether opportunity exists to incorporate alternative data.

We’re increasingly seeing companies use advanced data and benchmarking to not only increase accuracy but also actionability. Companies enabling this include Vic.ai, which is leveraging a unique data set to provide intelligent spend and bill payment capabilities that can identify deviations in typical patterns or ingest a new invoice template sent by existing suppliers.

Companies are increasingly focused on sustaining cash and runway for longer periods given downtrodden public and private markets. To do so, they are not only focusing on operating levers, such as balancing burn with growth, and financial levers, such as tapping into revolving lines of credit or accessing growth capital, but also turning towards new strategies. These include FX hedging enabled by companies like Bound, optimizing sales tax outlays with companies like Anrok and/or preventing accidental churn through companies like Butter Payments.

On top of this, greater uncertainty has resulted in a more frequent cadence of budgeting, where some FP&A teams have shifted from quarterly to monthly rolling forecasts. Companies like Pigment, Mosaic, Abacum and Causal have cropped up, each addressing different segments of the market. These Wave 3.0 FP&A tools either build on top spreadsheets or seek to replace them entirely. Aside from cheaper price points than their Wave 1.0 counterparts, they also have cleaner user interfaces and more modular capabilities, so users without finance backgrounds can leverage these tools to make decisions too.

Moving money is not core to the user experience, so any time companies want to add a new payment method, teams have to work through many low-level ledgering and reconciliation problems. Correct classification can require judgment and critical thinking, and is characterized by many layers, from transaction-level, account-level, functional-level and group-level reporting requirements. This complexity makes the quote-to-revenue process heavily labor intensive, requiring significant attention from finance teams. This has given rise to a whole new role within the finance function that CFOs must manage–FinOps. There are companies like Proper and Fragment, which are automating much of the busy work related to receiving payments and allocating transactions to their respective reporting accounts.

CFOs’ needs are influencing the pricing and packaging of financial technology products. We’ve seen that companies have shifted to more flexible pricing models that map to the value that customers gain, such as consumption-based billing. Companies like Metronome have emerged to reliably process data at scale so that finance and payments teams don’t need to change any code to adjust their billing procedures or get developers involved. Traditionally, billing software vendors have struggled when processing a combination of one-time and subscription purchases due to different billing and provisioning processes for each business model. Sequence was founded with the premise of simplifying the billing process for any pricing or payment type, requiring little-to-no code to change and improving the data exchange between finance, sales, and repository software.

The Office of the CFO landscape is wide-ranging and nuanced across different financial products, enablement software and core software tools; we’re only scratching the surface of how many compelling opportunities there are for this category across the US and Europe. So if you’re solving a problem in this space, let’s chat! tdimitrova@baincapital.com

We’re at the scary part of “the hero’s journey” in fintech, with a bottom for funding and a BaaS crisis, but we’re about to enter a new, exciting stage.

Relay is reinventing banking with more software and intelligence for every small business owner.

Generative AI can make companies more efficient, but customers have more to gain from it than they do — including in banking, commerce and medicine.