How Relay Is Building a Command Center for Small Businesses Across America

Relay is reinventing banking with more software and intelligence for every small business owner.

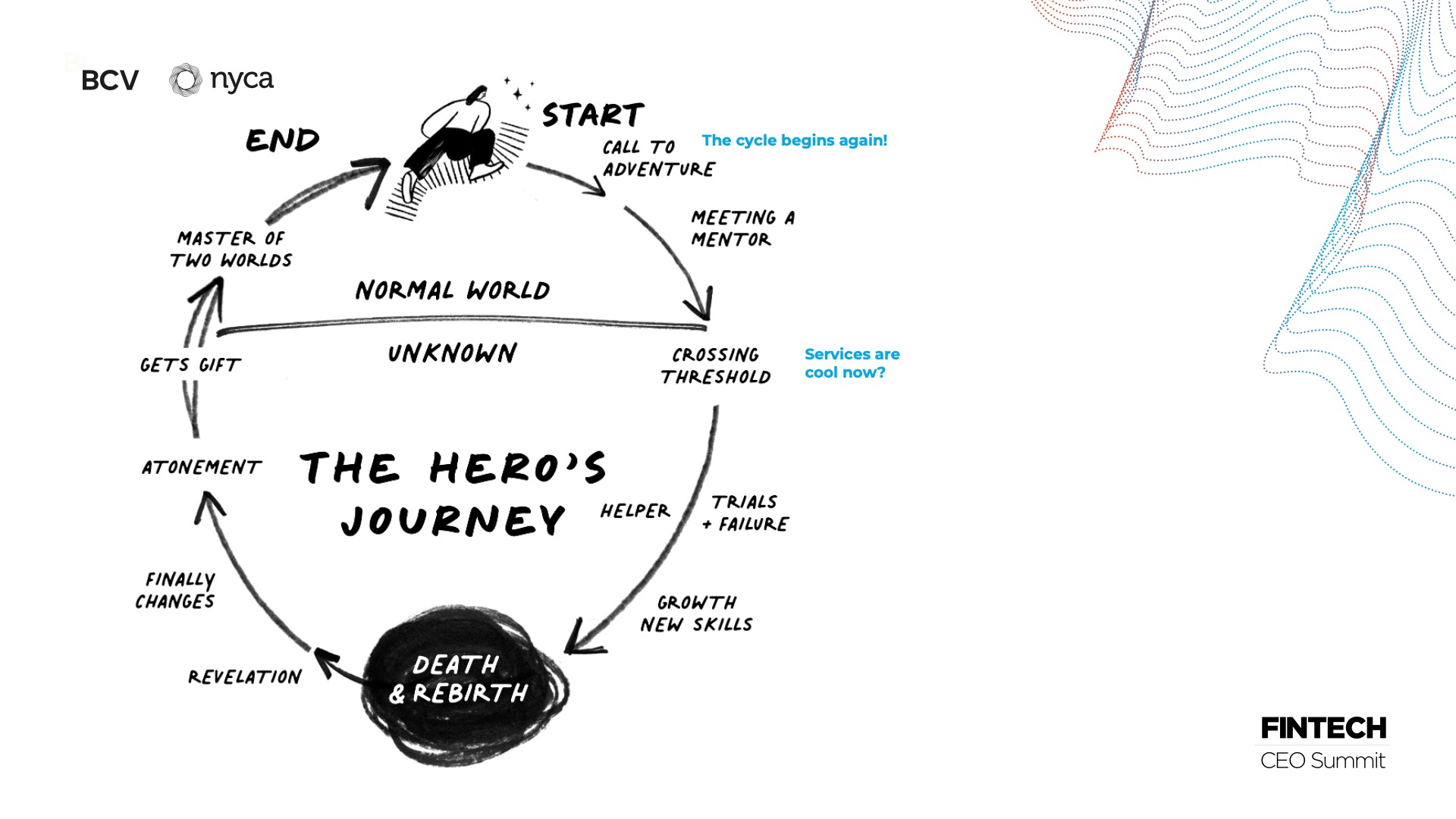

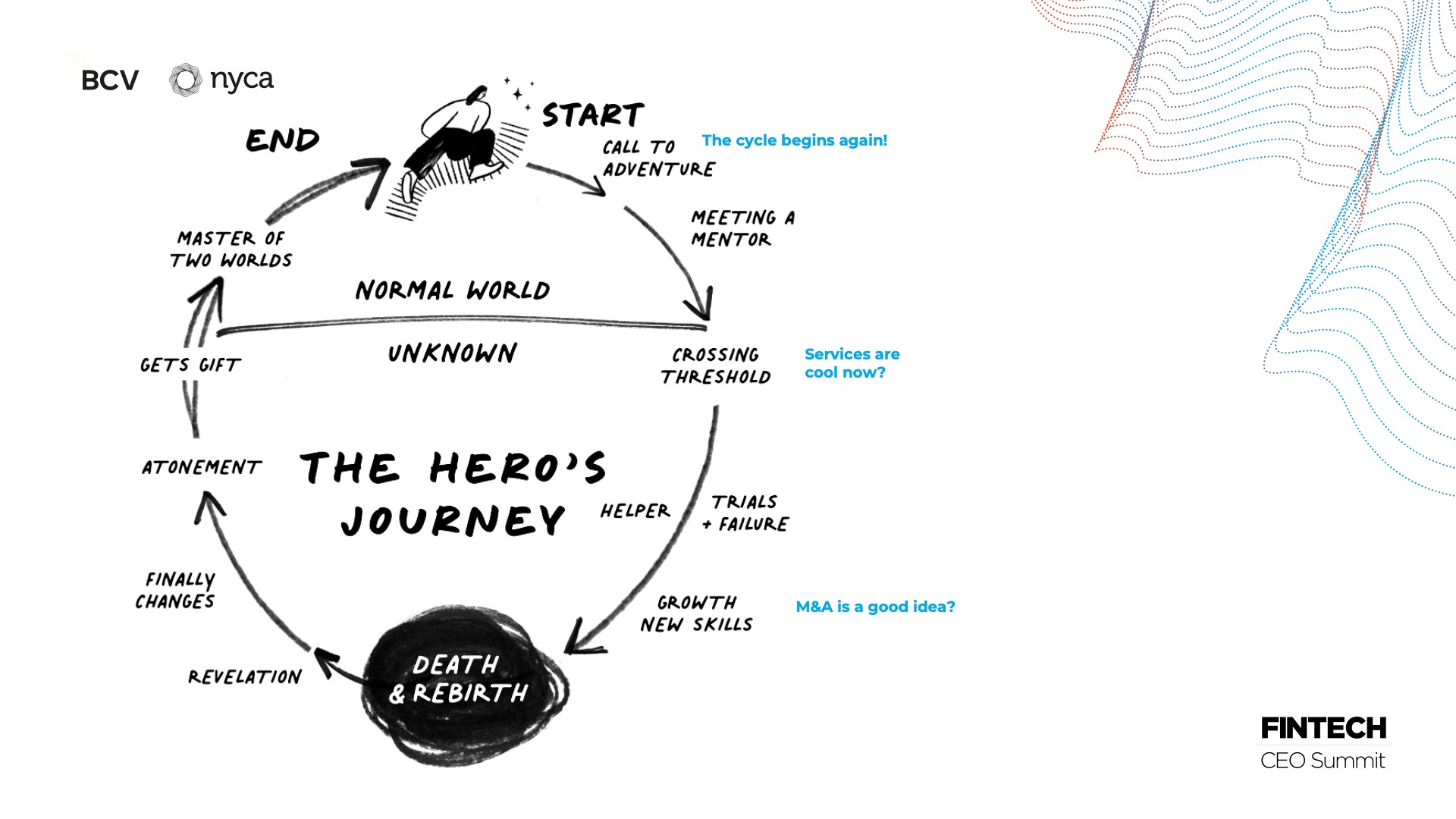

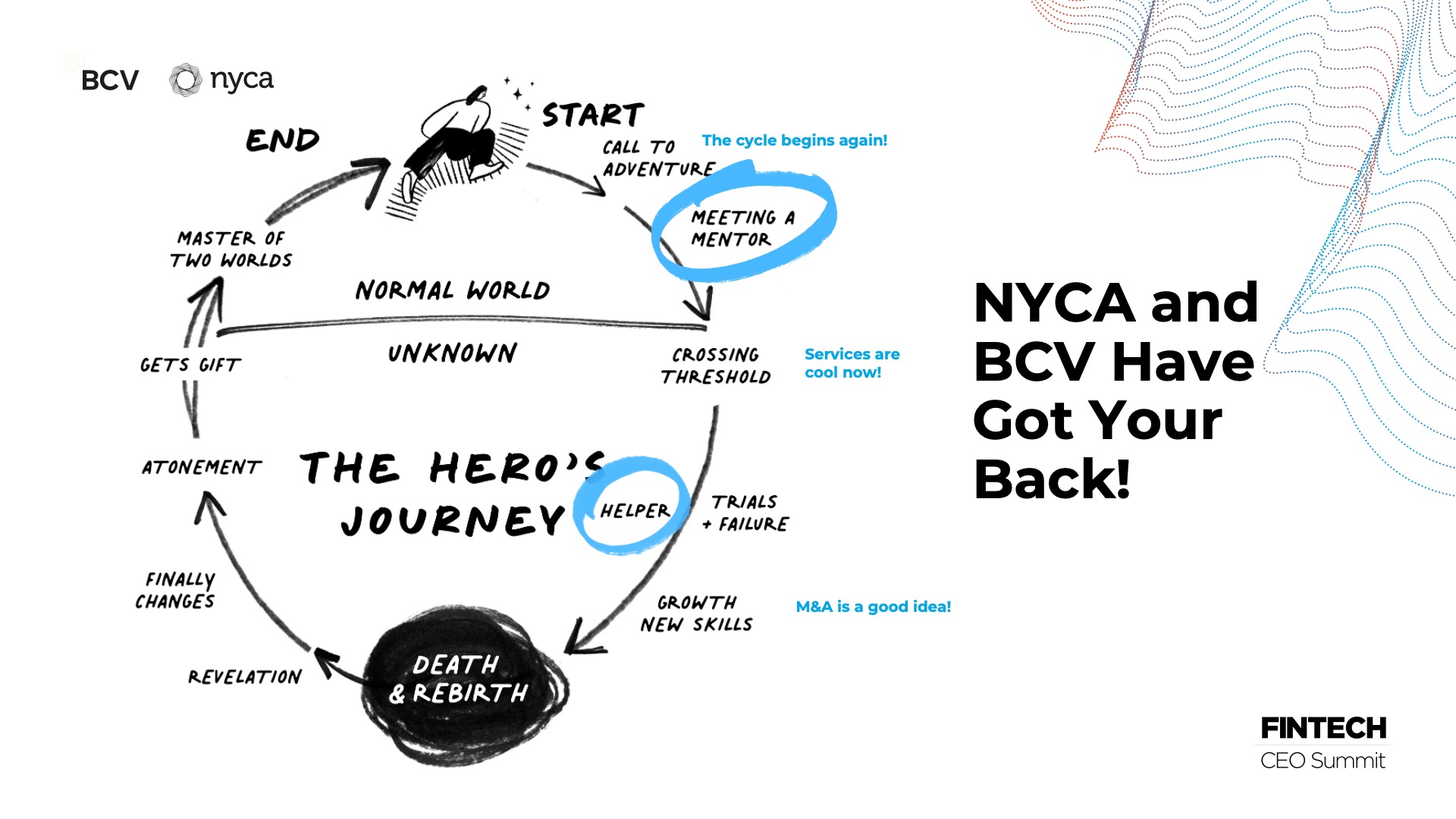

We’re at the scary part of “the hero’s journey” in fintech, with a bottom for funding and a BaaS crisis, but we’re about to enter a new, exciting stage.

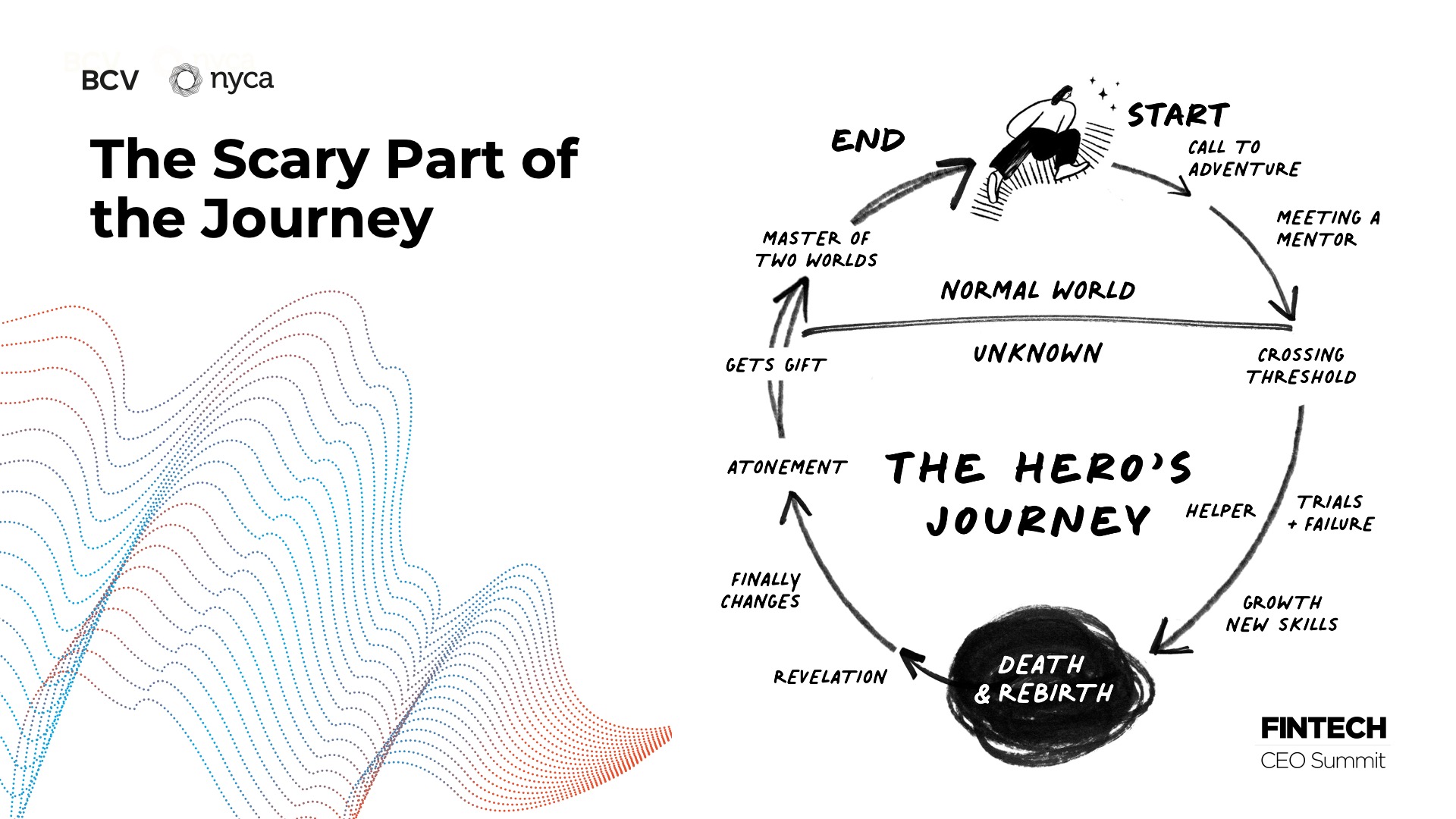

A year ago, I gave a presentation about the state of fintech called “The Fog of War.” It featured some illustrations of soldiers and white water rapids and admittedly, it was a bit bleak! For the 2024 Fintech CEO Summit, which we again co-hosted with Nyca Partners’ Hans Morris and his team, I wanted to spend more time getting optimistic about where we’re headed. For that, I turned to a device popularized by Joseph Campbell, the “hero’s journey” cycle.

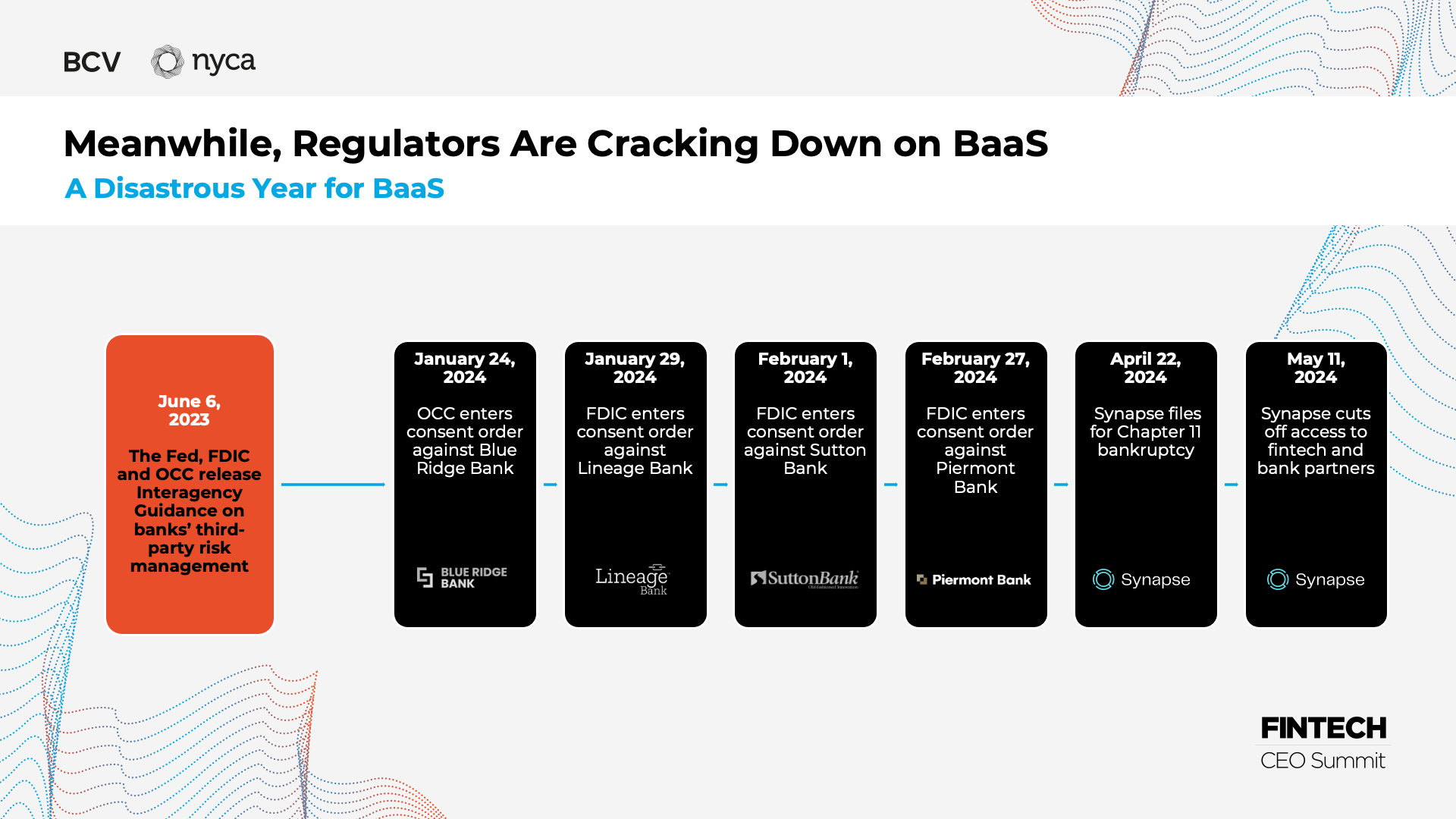

In my presentation, “Up From the Bottom,” which you can find in full below — a video from the event and, if you prefer, a transcript with slides — I don’t pretend that we’re not still in the scary part of the journey. We’re bouncing along a bottom for the industry and regulators, still smarting from the Silicon Valley Bank failure, are waging war on banking-as-a-service (which I’ve previously written about) and Synapse’s collapse is a historic disaster.

But the rest of the hero’s journey cycle is becoming clear, and provides a set of lessons for fintech companies. We can say goodbye to middleware BaaS, the era of regulatory arbitrage and the days when a fintech could be mainly “fin” or mainly “tech.”

Meanwhile, banks’ net interest margin revenue models are facing an existential crisis over the next five years due to generative AI, and that provides founders with big opportunities to build interesting businesses.

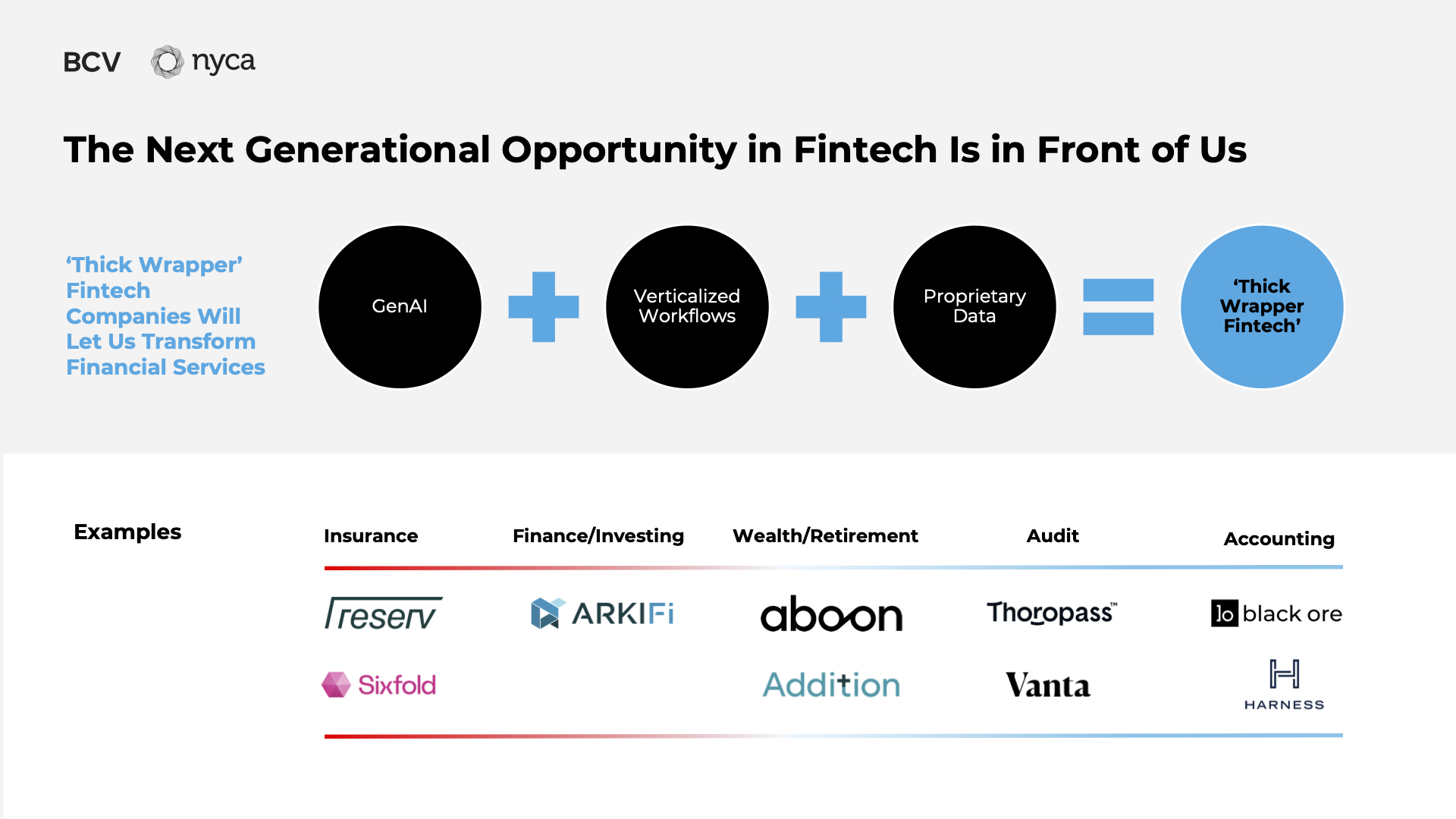

In my presentation I focus on one big area of opportunity in financial services, with what we’re calling “thick wrapper” fintech, and also look ahead to another previously taboo topic, the appeal of M&A.

It’s never fun to be in the “death and rebirth” part of a journey, but the fog is clearing, and in the distance is an open field of possibilities to build upon, if we’re willing to do difficult things.

The following transcript has been lightly edited for clarity.

Thank you all once again for indulging me in 20 minutes of rumination. In my defense, I do get asked a lot about what’s going on in fintech, and so I thought this is always an efficient way to summarize what is happening right now for your consideration. Let’s see. I’ve got some slides. Let’s start with the first graphic here.

So these guys look pretty comfortable at the bottom of a valley here, but I titled this talk “Up From the Bottom,” and there’s a lot of semantic content in that phrase. What we’re going to do here in this presentation is start with the bottom part. Because it really does feel like that’s where we are right now as it relates to fintech.

And what I would submit to you is that’s a good thing. We should be celebrating that. It could be worse than the bottom. You could be headed down a steep trajectory and I believe — and I think the data suggests and supports that — that is no longer happening. So we are bouncing along the bottom, but we’re going to end by talking about coming up from the bottom and finding the top once again. So as we get dark and depressing, please remember that, that part is coming and you’ll find it at the end.

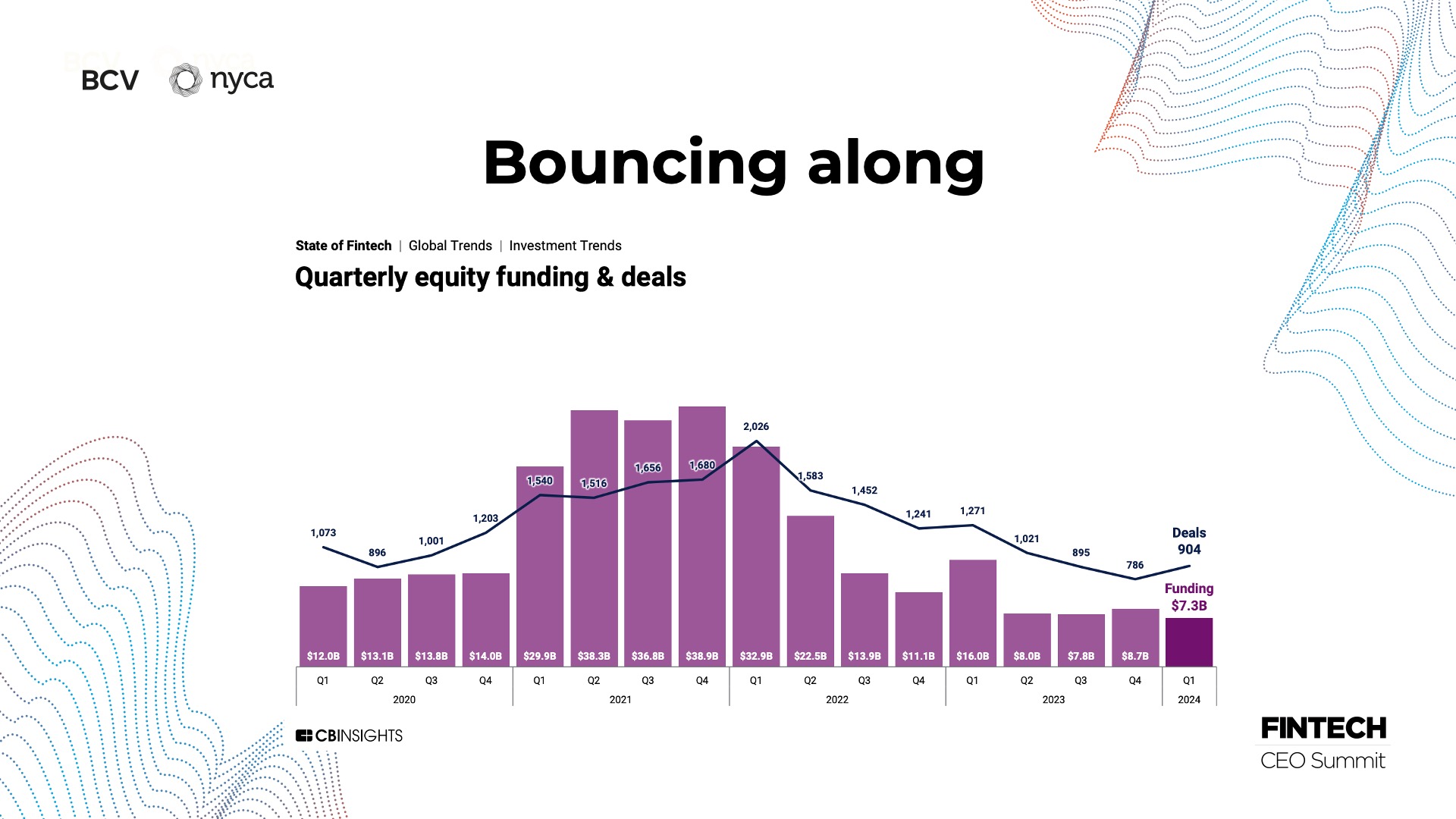

As I mentioned, the data. So this is equity funding and I think it does support this idea that we haven’t started to climb again. And of course it allows for the possibility that we find new bottoms, but, I think, — and this is also very much the lived experience of investors, founders, operators and builders in fintech, as well — we seem to have reached a plateau. And it is a plateau that is markedly lower than what had become the new normal.

I mean it’s even lower, as you can see, than that first quarter, the furthest left line, the first quarter of 2020 — a pre-COVID mark. And we’re meaningfully under that. So we’re somewhere in 2017, 2018 as it relates to people’s excitement about fintech.

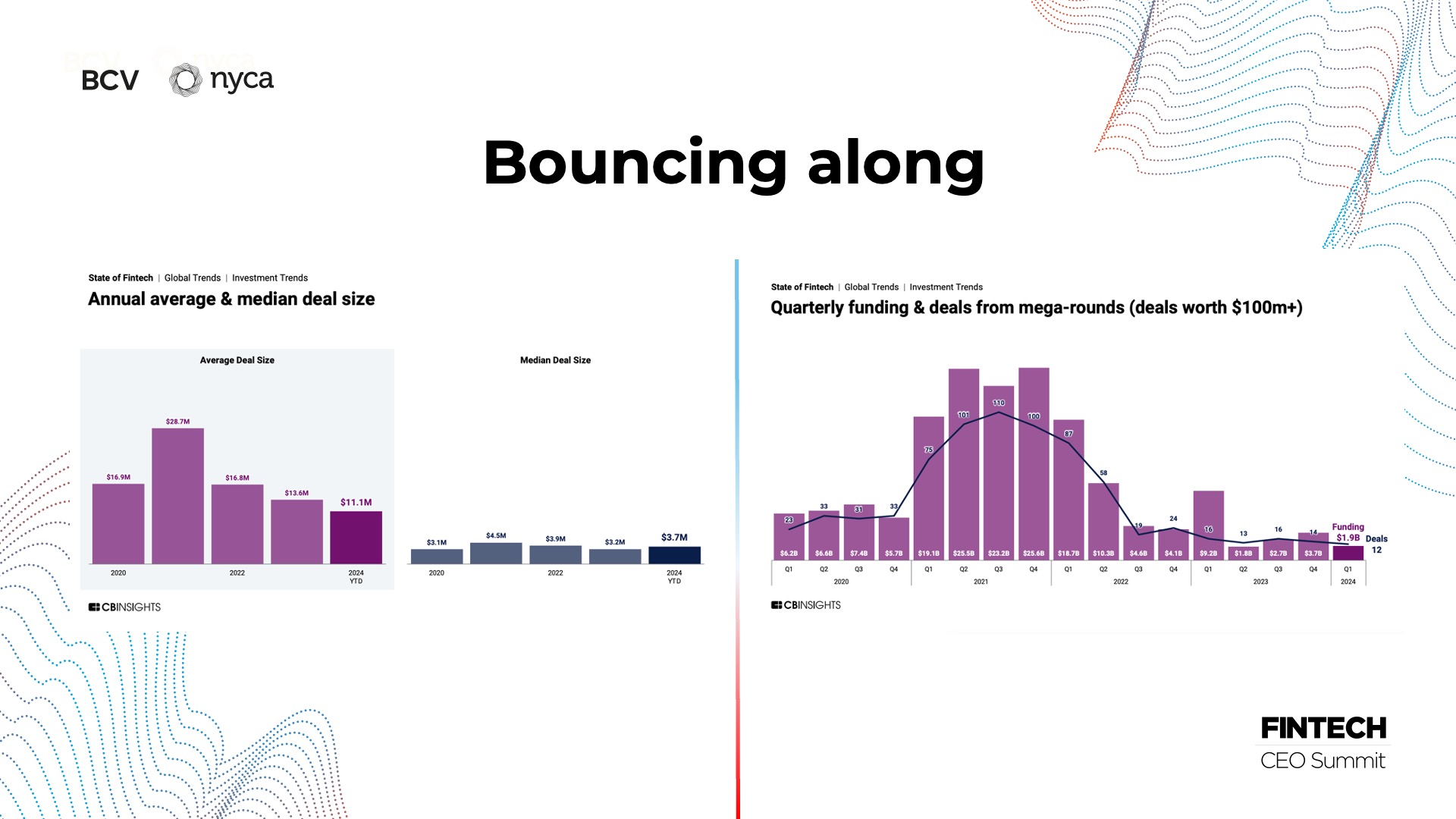

Just a few more supporting data points. Deals are down. The size of deals, the median size is about the same, but the average size is way down and that’s because there are just far, far fewer mega deals. I will say what’s interesting to me is that I do think this is what’s going to change first. I don’t want to name any names, but if you think about the bold-faced companies of fintech that we can all imagine now — Stripe obviously is one of those and very publicly came back and did a massive down round, and then Ramp did a massive down round.

If I just reflect on the meetings that we’ve been taking in the past quarter or so, I think — I’m certain — we’re going to see similar prints of that type, which is to say 50% down rounds from some of the biggest and most famous companies in fintech, off of rounds that were three years old. So they’ve grown for three years and are taking a 50% down round, which is exactly what happened with Stripe and what happened with Ramp. We’re going to see any company you can think of that is in that club do something similar.

Maybe that’s purely secondary just to provide employee liquidity, because these companies are extremely well-funded. So that is going to start picking things up off the bottom. And I think as it did in my experience with Stripe and Ramp, it gives permission to founders to shrug off a lot of the burdens that you all and many in the industry have been carrying — the valuations that have been weighing you down, in some cases for two years, and say, “Look, that happened. Opex got bigger than it needed to be, our valuations got way ahead of ourselves, but in fact we still have a great company.”

There could be a mark of pride in reestablishing that investors have ongoing interest in your company even if the price isn’t exactly what it was a few years earlier.

So from a venture funding perspective, we’re bouncing along the bottom. Unfortunately, the banking industry is in the second or third inning of what I think is, and I talked about this last year this time, a very problematic situation.

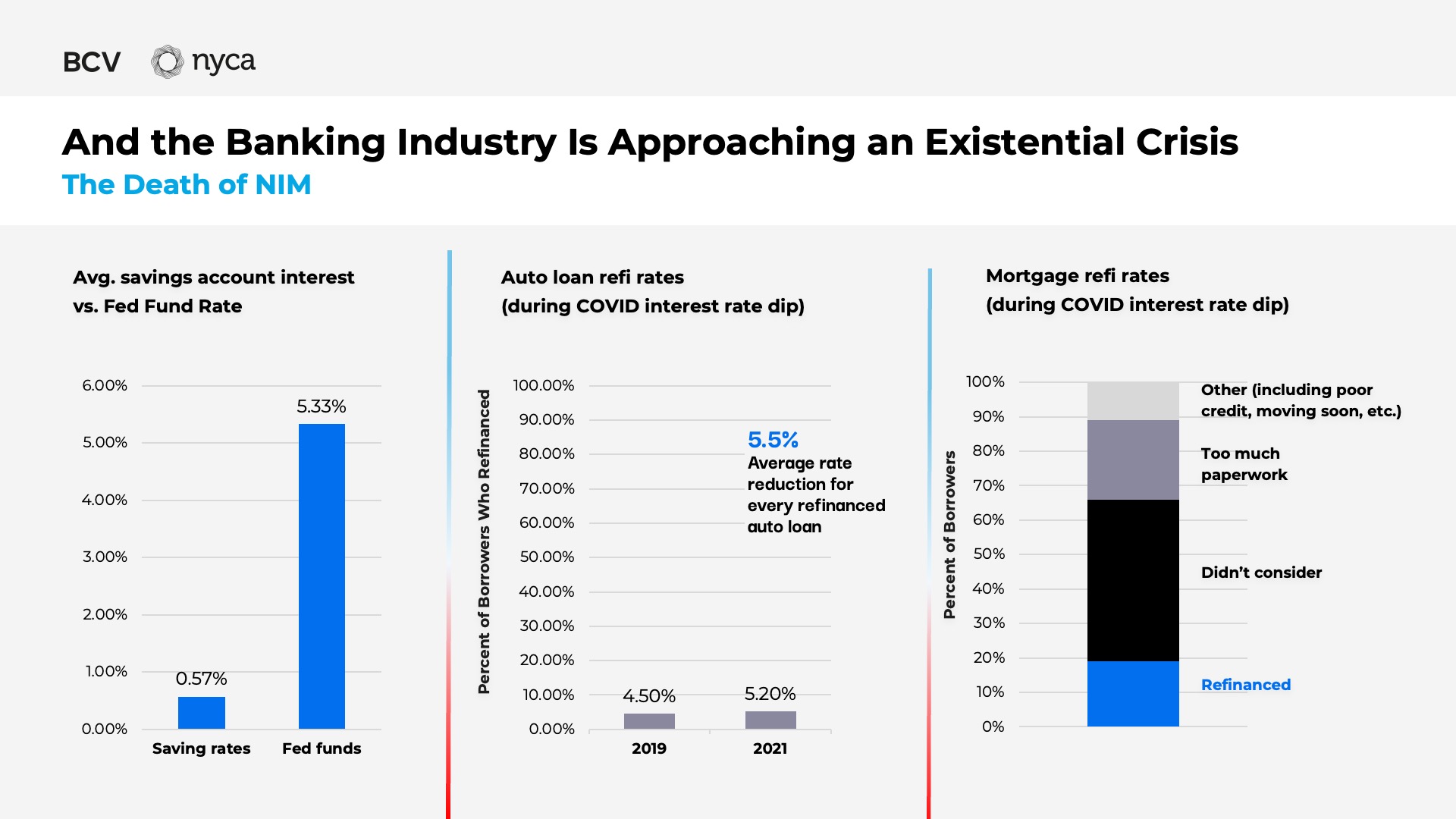

It is this thing I call the “death of NIM.” And these charts to me demonstrate the level of inertia that exists in U.S. consumer retail banking. Right now, you can go get a high-yield savings account or buy treasuries and get paid over 500 basis points in any amount of cash that you want. It’s not a promotional rate, it’s not only if you have a lot of money — it is available to anyone. And yet the average savings account in the United States pays 53 basis points. And that 500 basis points is laziness. A hundred percent. That is U.S. consumer inertia.

And the same is true on the debt side of the balance sheet for U.S. consumers. During COVID, as we all know, interest rates went to zero.

And so you might ask yourself what percent of U.S. consumers decided this would be a good time to refinance their debts, all of which were priced at a spread over a much higher base rate. And the answer is almost none of us did that. Five percent of people refinanced their auto loan, 19% of people refinanced their mortgage. And some had good reasons for not doing it — it was a very recent mortgage and rates maybe hadn’t gone down that much from it, or they had to suffer a loss in deterioration in credit — but most of us just couldn’t get around to doing it. Even though the dollar savings for us would’ve been massive. On the auto side, over 500 basis points of saving in rate, and on the mortgage side, only 2- or 300 basis points probably, but boy, against a big, big number in most every case.

So NIM is this exercise where banks pay you as little as possible and they charge you as much as possible.

On average, they enjoy around 300 basis points in the middle, that net interest margin. And U.S. banking — actually, global retail banking — is one of the only industries I can think of where if every customer of a retail bank woke up tomorrow and did the thing that was in their best interest, they would all leave their bank instantly. No single customer is actually well served by their bank, and the entire banking industry is designed to take advantage of them.

And I’ll say this, I love banks! I think banks are incredibly important infrastructure for the global economy. We need them to be healthy. We’ve seen what happens when they get unhealthy. So this is not actually a critique of banks, it’s just the fact that the entire industry rests on a foundation of high latency, high opacity and, most importantly, massive and comprehensive inertia, which is driven by customer laziness.

People just do not vigorously pursue their self-interest when they face off against banks and they’re aware that it would be really slow and burdensome to do so even if they rouse themselves to do it. It would take a long time and they’re not really fully aware at all times of the best alternatives.

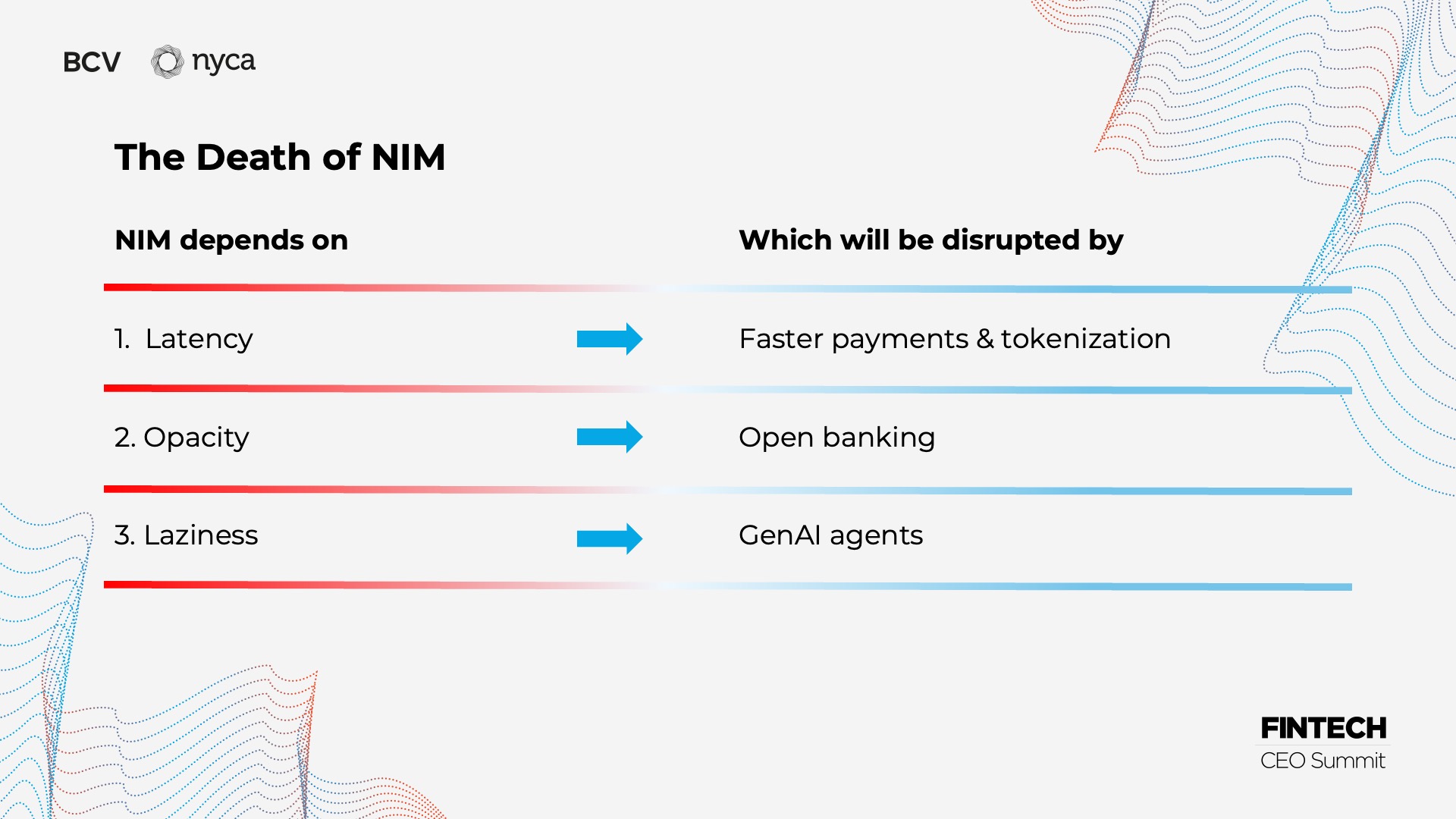

I would submit to you that in some period of time in the next five years, all three of those conditions are going to go away. And when they do, we will see this radical transformation of banking, whether we like it or not — and I don’t think we’re going to like it. Because the banks don’t really have another act that replaces 300 basis points of net interest margin. And the latency is going away because of real-time payments that are happening slowly but inevitably, and happening globally. You also have this advent of — the reemergence, really — of tokenization with stable coins, which dramatically reduce settlement times.

It’s a longer conversation, but one of the most important themes in fintech right now is the fact that crypto, which has been so dramatically under a dark cloud the last couple of years, is reemerging in the form of tokenization and stablecoins in a way that should all be paying a lot of attention to.

Opacity is on its way out the door because open banking is finally getting the government support that it’s been promised since the Dodd-Frank Act.

Most importantly is that something generative AI is actually going to change is how much attention you have to pay to these matters. We will all have agents working on our behalf to migrate our savings to the highest interest rate as many times a day as we want to set it to, and to refinance all of our credit as many times a day as we want to. This to me is the death knell, built on top of full transparency, built on top of the death of latency, and that will be the death of inertia.

We can be as lazy as we want when we have agents with power of attorney that are optimizing our financial lives. People talk about “autonomous driving” for your money — and people have been talking about that for a long time — but when it comes, it’s going to be very dramatic and it’s going to be really bad for banking.

The thing that does actually surprise me is that the regulators —some of whom, former regulators, are in this room, others of whom will be here later today — do not seem to be preparing for a world in which life gets really hard for banks. In fact, they seem to be kind of systematically preventing the sort of circumstances that might give banks a reason to exist. As I think about what I would do if I were running a bank, one would be you really have to get big to survive.

So net interest margin, it won’t go to zero quickly, but say it gets cut in half because deposit beta, the activity that your customers undertake when interest rates go up and go down, increases dramatically. People actually seek out the highest rate, so net interest margin contracts. Banks are fixed cost businesses, and so you want as much in the way of assets to apply to that against that smaller net interest margin as possible, to be able to afford the fixed costs that are irreducible in banking.

So we need 4,500 banks to shrink. That number has to shrink to a much more manageable number of, generally speaking, far larger average banks. And the government is just categorically against banking combinations and that number has been stubbornly high for a long time. Shrinking, but stubbornly high and not shrinking fast. So the regulators have said, “We don’t want bank consolidation at any rapid pace.”

One of the paths to glory for banks is to provide wholesale infrastructure to technology companies. Chris [Dean, Treasury Prime co-founder and CEO] mentioned that he may be the last BaaS player left. I mean there’s a wholesale die-out of the BaaS population happening right now. The banks are being forced to stop working with fintech companies. That was one of the three things they could have done for some part of them to survive and have a fruitful life, by providing the regulatory and compliance infrastructure to allow innovation to happen.

As of now, the government has decided they don’t want that to happen. That has got to change. And it will change, and we’ll talk a little bit more about that.

Leveraging embedded finance is one of the paths to glory. The other one, for what it’s worth, is to start doing hard things. I think banking made its own bed when it decided to basically just lend on a FICO score. Lending has become a nearly pure commodity in the United States.

It didn’t have to be that way. It doesn’t have to be that way. Banks could be creative lenders instead of letting private capital, private credit, fund-based lenders and fintech companies actually do all of the innovation. And yet the regulators do not want banks doing any of that.

If they have their way with Basel Endgame, it will be prohibited for banks to engage in any kind of creative lending. So systematically the regulators are taking away all the avenues to survival of the retail banking system, and I don’t think that’s going to end particularly well. And I think that will have knock on effects, unfortunately, for the fintech community.

So I put together this graphic, or rather Annie, our brilliant head of design, put together this graphic. I don’t know if people are familiar with the hero’s journey. It was popularized by Joseph Campbell in “The Hero With a Thousand Faces” and in many of his subsequent books.

He popularized it, because this has been around for thousands of years, this sort of archetypal myth story of the hero. It has this characteristic shape. This is in “Ulysses,” it’s in “Star Wars,” it’s in “The Matrix” and it’s in many of the tales that survive and many modern, contemporary stories — this same arc of the hero going through challenges, facing transformation and emerging victorious and transformed.

And we’re at the bottom, as I said. This is the hard part. We are, I think, not sliding anymore, but we are in the middle of the hard part. And so I want to talk a little bit, using this framework, about how we come back and then how we start again. Because the other thing about this, the other thing about my experience of life, is everything goes in cycles.

When we in this room, we who have somewhat more mature fintech companies, had this idea that the financial services architecture was going to change, we thought fintech companies could flourish by being built on top of banks and insurance companies. This architecture of regulated FIs, middleware and application companies — that is going through this period of existential crisis. I want to talk about how we get out of that, but I also want to talk about what comes next, and the next cycle that’s being born as that other one reaches its conclusion.

I just love Joseph Campbell so much and I recommend his books and his theories to you. Everything he says about the stages of the hero’s journey resonates with me so dramatically, so much so that I could just literally slot in what I think is going to happen next against this archetypal image of the hero’s journey.

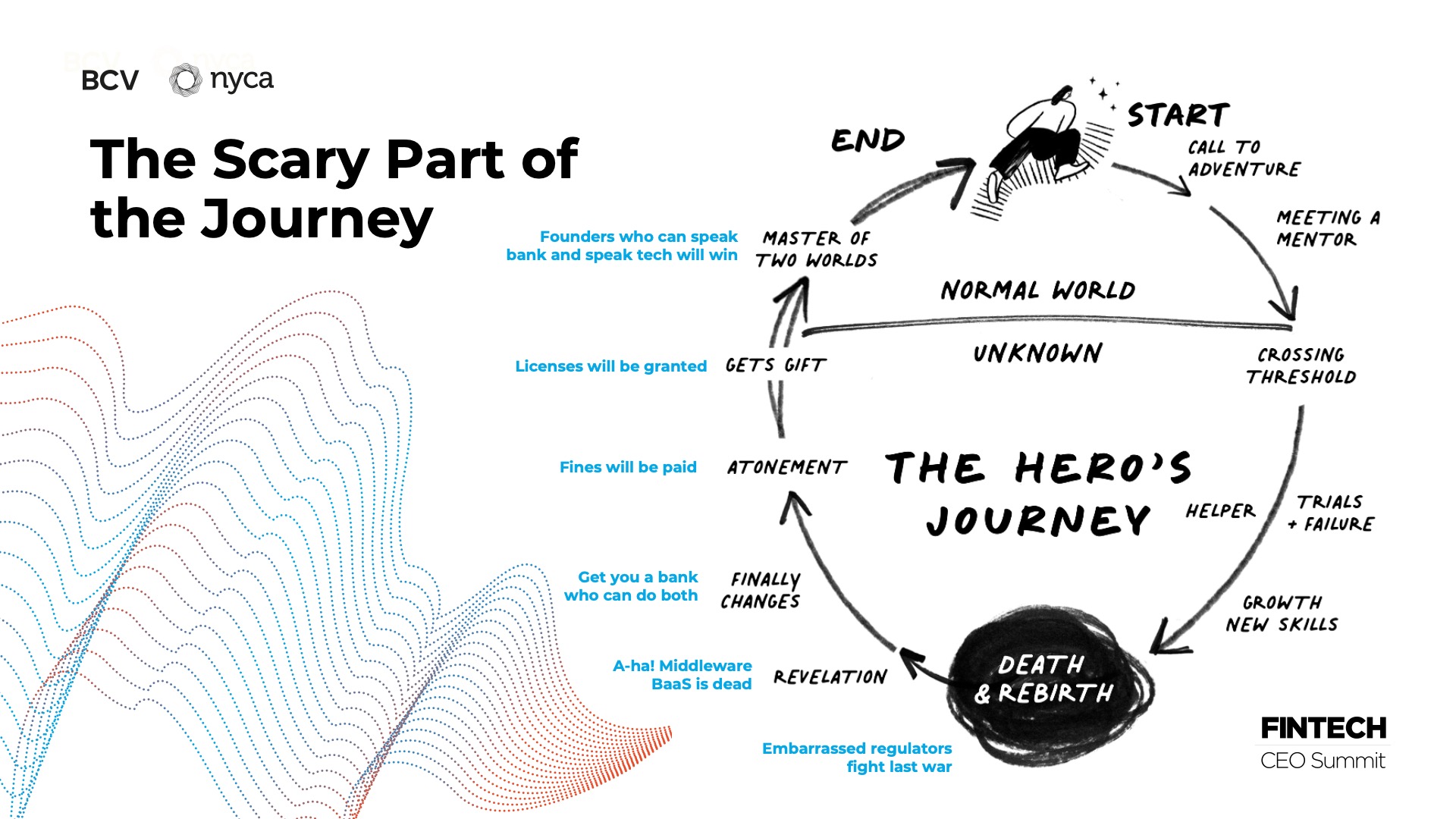

Death and rebirth is not a fun spot. Right now we have these really embarrassed regulators. Why are they embarrassed? Silicon Valley Bank was a really bad moment in the U.S. regulatory system. Everyone had egg on their face. I actually think they handled it brilliantly. I think we should be handing out medals, but it was an oversight failure. And so the level of vigor by which they are forcing this tumult is quite striking.

Middleware BaaS is dead. That is, I think, the revelation that people need to take onboard.

If you are a fintech company and you are not dealing directly with a financial institution, you need to fix that. I mean the Synapse trial, if you go read through what’s happening day to day and imagine yourself as a regulator, seeing how this middleware company and its relationship with its underlying banks fell apart, and in doing so, denied access to savings for tens of thousands of people that were customers of fintech companies — those transcripts of that trial are going to be taught in history books. And it represents the end of this era. It was ending. It really started ending with the interagency guidance last summer, but it died in that courtroom.

So if you are a fintech company and you are not working with a bank directly or insurance company or a broker dealer, you need to fix that. You need to say, “I’m sorry,” to the middleware company. “Thank you for your service. Exit stage left. We’re going direct.” And if you are a middleware company, you need to do what Chris did and become a vendor to banks and realize that your job is to make them successful. Because the future is about the banks, the very, very few banks who have the capabilities to actually deal directly with fintech companies with sophisticated compliance technology and the ability to push back against the regulators, and there aren’t that many of them.

The “Finally Changes” part: You really need to get a bank who understands your world and understands regulation. And there aren’t many. There will be many born. Lead and Column and Thread — there are a few new banks. I do believe there will be more charters issued slowly. I do believe there will be changes in leadership at existing banks. This population of banks is incredibly important.

We are going to go through a period of atonement. Many, many companies are going to pay lots and lots of fines for stuff they did, including fintech companies who are not regulated particularly, but will find themselves kind of dragged into it in the way that Chime was dragged into it recently for a very, very small technical problem. But they were dragged in and had to pay a fine to the regulators. This is what they do and that will happen. And that can’t be like some scarlet letter; that has to be the moment you expunge your guilt. That is part of the hero’s journey.

It really has to happen before you can get the “gift,” which is more and more fintech companies are going to become licensed banks, or licensed insurance carriers, or money transmitters — whatever the licensure is that is germane to your field of endeavor. You’ve probably tried to avoid it. You have likely said to yourself, “Part of our game here is,” it’s an ugly word but, “regulatory arbitrage. We can move much faster. We’re not in X, Y and Z. We have these advantages.”

That era of fintech, that era of regulatory arbitrage, is coming to an end. And so considering and getting ahead of the process of potentially becoming licensed in your field of endeavor and facing off directly against regulators is worth consideration. That doesn’t mean you have to start it tomorrow. Maybe in your case it’s not relevant and you don’t have to pursue it. But more and more of the winners in the world of fintech will actually have the license that when the government set up the systems they intended for participants to have. That’s not actually not a crazy thought on the face of it. And so that’s worth thinking about. What does that mean for you in your line of work?

And there’s this great notion, and I think something we can all aspire to, this “Master of Two Worlds.” That’s the winning formula. We had the days when fintech could either be mainly “fin” or mainly “tech” — the winners are going to be people who truly are masters of both of those worlds.

So as it relates to kind of the denouement of this latest chapter, I think we are coming out of this bottom and starting on this ascendancy, which has its own challenges, has its own rigors, particularly as you think about the regulatory challenges that each of you might face, or that your customers might face. Very few companies in this room will be unaffected by this.

But I see a path to a much more durable and stable set of competitive advantages. To the extent to which you’re competing against institutions that are historically NIM-based revenue models, I can guarantee you this, they will be mightily distracted over the next five years. And there are big opportunities to build interesting businesses.

This relates to insurance, as well. NIM isn’t exactly the same, but you’ve got a lot of benefits of inertia, particularly in life and annuities, that over a longer arc will start to become challenges there, as well.

So as one cycle ends, definitely another one begins. And we just have glimpses, in my mind, just glimpses of what the next value creation cycle will be. We’re now in the other half of the hero’s journey. We get to do the exciting stuff. But what is consistent — what was a challenging idea at the beginning of fintech was, oh wait, these non-bank, non-insurance, non-broker dealer companies can provide these services. That was the transgressive flip between the normal world and the unknown. And again, we’re well past that now. That’s 20 years ago. So what is the flip that’s happening now? What are the things that are defying convention and opening our eyes to the potentially first half, this incredibly exciting half of the next hero’s journey? I think there are several, and I want to talk about them a little bit.

The first one is services being cool. This is a bit of a generative AI story for sure, and I do despise the fact that I have to be so trite and get up here and tell you why generative AI is exciting. And yet as we learned on Noah’s panel and as of course it’s hard to ignore, this is an important new technology. It’s the culmination of years and years of underpinnings, but it is an important breakthrough and the pace of change is speeding up.

One of the things that is engendering is what we call “thick wrappers.” Everyone has different names for them. People have talked at length about the transition between services and software, about how what have historically been very labor-intensive services are becoming more software-like in their conceivable level of automation and therefore the gross margin and contribution margins relate to what have historically been very labor-intensive services.

There are still a lot of people who find this challenging and difficult. There are people who say, “We can’t invest in this type of company, it’s a services company, it’ll never be valuable. It’ll trade at X, Y, Z multiples. Gross margins will harmonize down to the historically 30-40% levels they’ve always been. I don’t believe that generative AI or any associated technologies can actually reduce the human level of engagement.”

These are all legitimate objections. If there weren’t objections, we wouldn’t have an opportunity. We internally are extremely convinced that these objections are overwrought. What we’re seeing at some of these companies, many of which are our portfolio companies, is actual proof of the ability of these technologies and more traditional AI to overwhelm the historically stubborn human costs in some of these businesses. And so we are fundamentally convinced that the investible field within financial services is well beyond just software companies.

In fact, in parallel, we’re a little bit concerned about investing in software companies. Because it used to be the case that the elegance, comprehensiveness, depth and breadth of your software was a tremendous moat. In a world where generative AI impacts programming the way it might — not the way it is now, but the way it might — it could be that software becomes a nearly pure commodity. That with human language scripts, you can actually tell the computer to go program something, test it, program it again, program it seven different ways, test them against each other and have incredible software built by laypeople using human language, basically just a product function facing off against generative AI. That could be what happens in two years. Where’s the software moat then? This becomes the moat, the interface between human activity and computer activity, training generative AI to take the place of humans.

We can ask other questions about the impact on our society of that and there are problems that come from that, but doing these very, very hard things — historically impossible things — I would submit to you is how you should be tasking yourself and your company. Because the easy things are going to get easier and ultimately then they’re going to be out of the realm of companies and into the realm of pure software. So services to software is one of those transgressive flips that you should be considering.

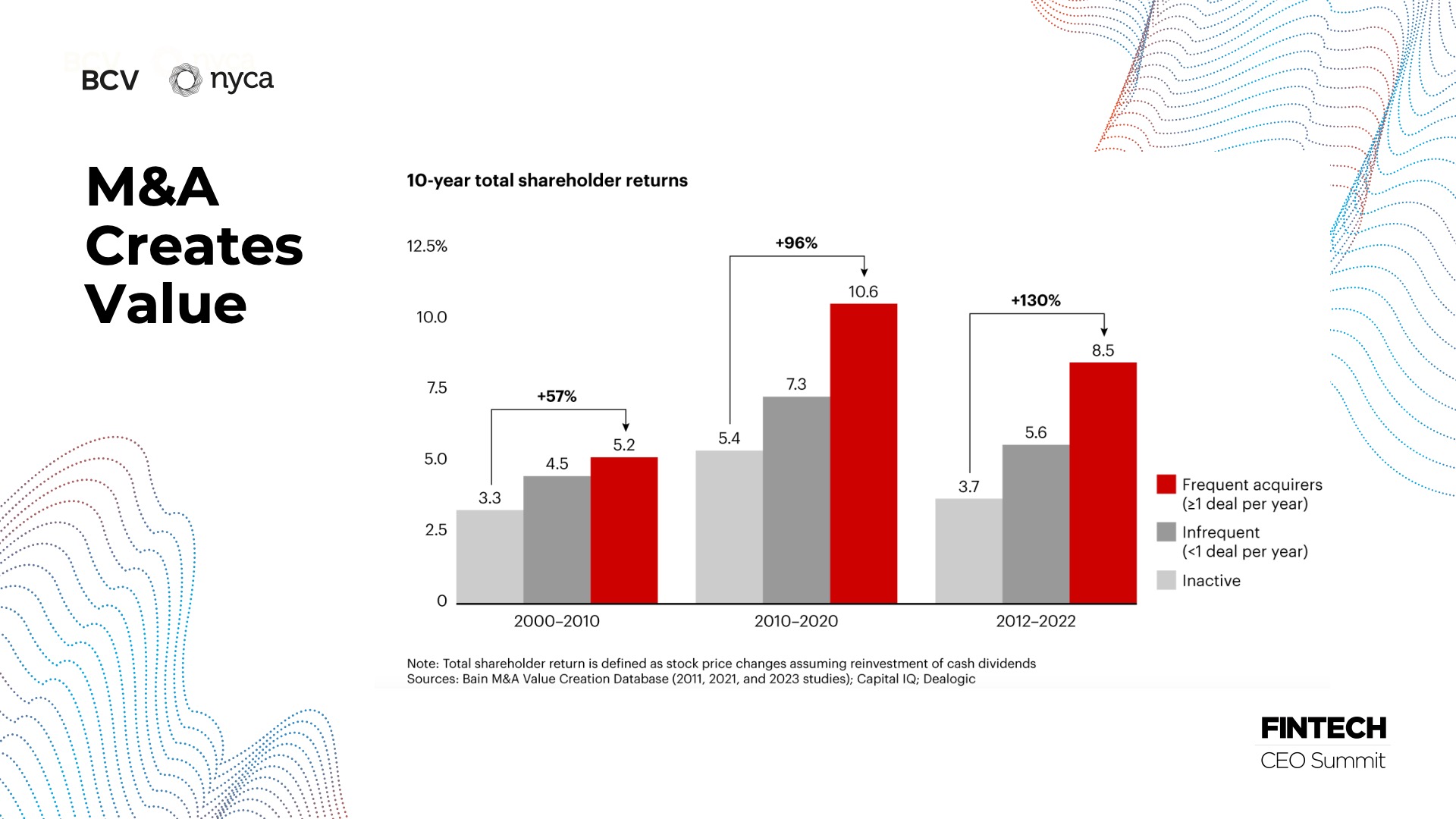

Another sort of historically taboo tactic I would say is high volume mergers and acquisitions. I was trying to research where this idea came from, but if you Google M&A success rates or whatever, you’ll find the statistic repeated everywhere that 70 to 90% of M&A fails. I’m sure we’ve all heard this at some point. It’s actually impossible to source where that came from. I think it was just like somebody whispered it once at a conference and everyone was like, yeah, that sounds like a good excuse for why mine failed. And so this has become part of the conventional wisdom.

Our cousins at Bain & Company did this study — and I think it actually matches with our experience — which says that like most things, if you are good at M&A, it can create enormous value. And it can actually be a wildly differentiated tool for company equity value creation.

Now, these aren’t like startups, these are public companies, because you need a dataset that has lots of data to look at. But what’s obvious to me from this dataset and actually marries with my lived experience over the past five years is that M&A is just an art. You can get really good at it. And if you get really good at it, it can create tons of value — and in particular, if you’re doing it in fields of endeavor that are going through a transition.

So a lot of this was extremely successful in vertical software where there was this embedded finance transition. And so if you could buy a vertical software company with no payments and you could bring payments, the success probabilities of that acquisition were just going to be way higher because of those lay-down, if well practiced, straightforward synergies of applying payments to vertical software.

In the wealth management space, you’ve seen serial acquirers create enormous value by bolting a very efficient chassis onto a very sticky front end. You’ve seen it in commercial insurance. We are going to see that in a number of these generative AI built services to software companies where high volume M&A by sophisticated M&A driven companies are critical to their success — instead of being sort of derided as 70-90% failure rate fields of endeavor.

There are going to be other things like these where you say to yourself that just flies in the face of conventional wisdom. I, as a business professional, have been told to never invest in services companies, and that M&A fails 70-90% of the time. We’re at one of these periods where we’re beginning again a cycle where the conventional wisdom is not your friend and it’s a great time to be a founder. You guys didn’t get here by thinking conventionally.

One of the other things that I love about this chart is how frequently it mentions helpers and mentors. We actually edited some of them off. But with the hero’s journey, Hans and I, and our partners and colleagues, we’re not the heroes of this journey, sadly for us. You guys are the heroes of this journey.

We have this incredible job. I spent today with [Flywire CEO] Mike Massaro onstage, and some of you saw how this is what we’re here to do. We’re just trying to help you go through this hero’s journey, sometimes as a mentor, much more often just as a sounding board and a shoulder to cry on, even, because this stuff is really hard.

But just please remember, it’s got this cyclical nature. When you’re down, it just means you’re about to go up. And there are people in this room from BCV, from Nyca, who are here to help you. Again, thank you for indulging me once a year. I appreciate it.

Relay is reinventing banking with more software and intelligence for every small business owner.

Generative AI can make companies more efficient, but customers have more to gain from it than they do — including in banking, commerce and medicine.

The BCV fintech partnership shares our comprehensive perspective on how generative artificial intelligence is reshaping the financial services industry.