Welcoming Joe DiMento to BCV

Based in San Francisco, Joe will focus on leading BCV’s customer development team, advising BCV portfolio companies on GTM initiatives, and building relationships and programs across Bain Capital and Bain & Company.

Today marks a major milestone for Bain Capital Ventures as we announce $1 billion in new funds to invest in the next generation of founders building disruptive companies.

Bain Capital has a long history of investing in innovation and technology starting with our early investments in companies like Staples in the 80s and DoubleClick in the 90s. Our technology investing efforts increased with the launch of our first dedicated venture fund in 2001, marking the formal beginning of Bain Capital Ventures.

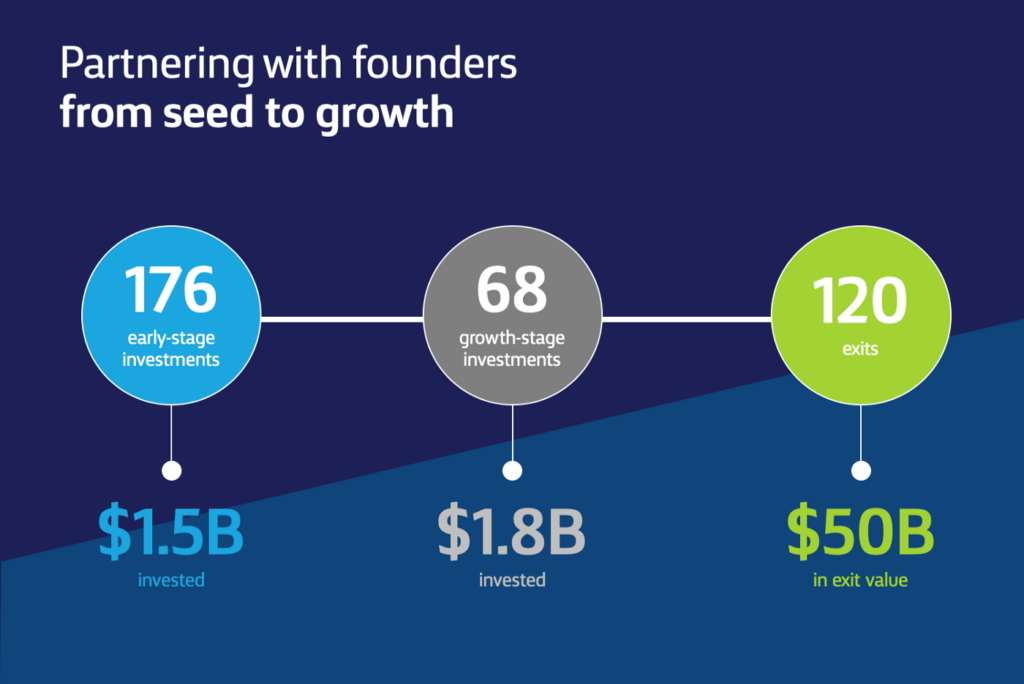

Over the course of the last 18 years, we’ve launched eight core funds and two co-investment funds and backed over 240 companies from early to growth. Our portfolio companies — including Liberty Dialysis, Taleo, Kiva Systems, SolarWinds, LinkedIn, and Jet.com — have created over $50 billion of total enterprise value along with countless jobs and innovations that have redefined entire industriesOver the last decade, we’ve significantly grown our team; expanded our footprint to include offices in Palo Alto, San Francisco, and New York; and built a partnership with deep experience in the major trends and tailwinds that are transforming every aspect of the global economy.

In 2011, we officially established our West Coast offices to accelerate our early stage efforts. Since, we’ve made over 100 early stage investments, including more than 50 seed investments, tripling our volume of seed and Series A investments from the prior decade. Today, nearly half of our team is on the West Coast complementing our teams in Boston and New York.

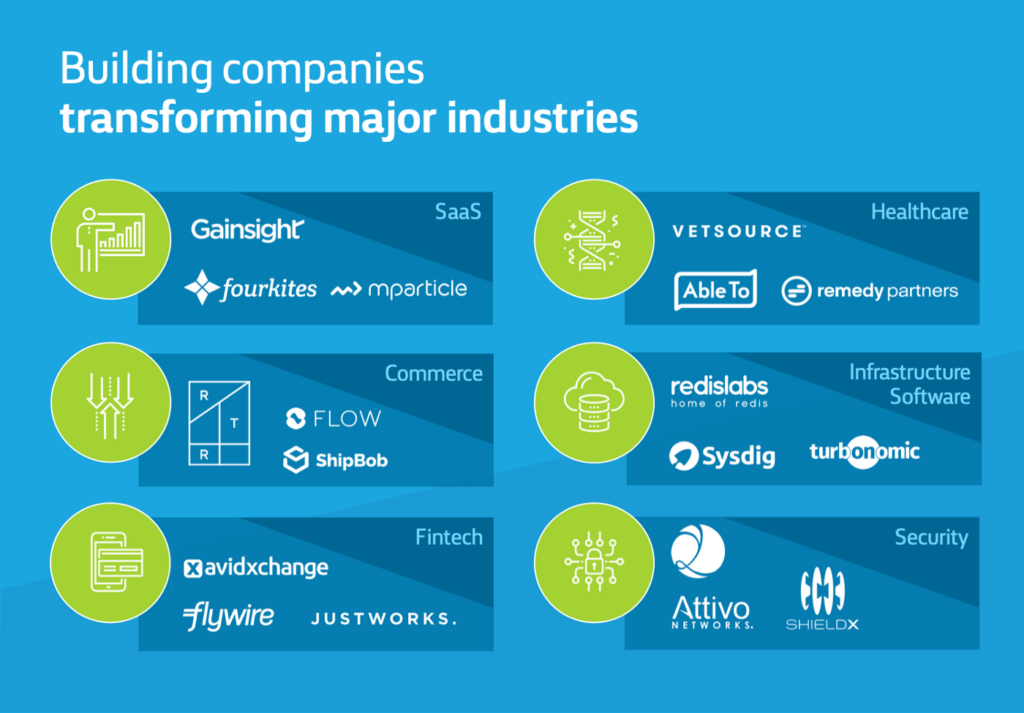

For disruptive B2B startups, we believe we have built a highly unique and differentiated platform to help founders grow their companies from the earliest stages. This starts with a partnership with deep domain expertise in infrastructure software, security, fintech, SaaS, healthcare, and commerce.

Our partners and investors leverage the global platform of Bain Capital to access networks and companies that are difficult for founders to reach on their own. And finally, through our funds, we have the capital necessary to help our founders and company leaders scale through different phases of their lifecycle.

We are proud of the many recent IPOs and billion-dollar valued companies that chose to partner with Bain Capital Ventures early on, including DocuSign, Jet.com, Rapid7, Remedy Partners, Rent the Runway, SendGrid, SquareTrade, SurveyMonkey, and many more.

And the group of earlier stage founders and CEOs who have chosen to partner with Bain Capital Ventures has never been stronger:

Jenn Hyman at Rent the Runway, Suresh Vasudevan at Sysdig, Nick Mehta at Gainsight, Brad Katsuyama at IEX, Isaac Oates at Justworks, Ishaan Nerurkar at LeapYear, Matt Elenjickal at FourKites, Mike Katz at mParticle, and Ashok Subramamian at Centivo.

Today, with $4.9 billion under management, our mission to invest in the very best entrepreneurs who are solving massive problems remains unwavering, even as the world around us looks radically different than it did in 2001. We have a team of 30 investors who are ready and excited to back the next generation of founders and startup leaders.

Thank you to our limited partners for entrusting us with their confidence and capital.

Above all, we are grateful to all of the incredible founders in our portfolio and to our extended community for the chance to play a part in creating the future and to make history alongside you.

Based in San Francisco, Joe will focus on leading BCV’s customer development team, advising BCV portfolio companies on GTM initiatives, and building relationships and programs across Bain Capital and Bain & Company.

Cube is the standard for providing semantic consistency to LLMs, and we are investing in a new $25M financing after leading the seed round in 2020.

You’ve got a lot of hats. Here’s how to wear them well. As an early-stage founder, you’re doing it all. Recruiting a team, raising money, managing product, establishing a brand and culture, and telling the world why it should pay attention. Thankfully, our Investor and Platform team leaders have lived through it on both the…