Only Up From Here: 2024’s State of Fintech and the Hero’s Journey

We’re at the scary part of “the hero’s journey” in fintech, with a bottom for funding and a BaaS crisis, but we’re about to enter a new, exciting stage.

One aspect of the banking crisis is over, but generative AI stands to vanquish hundreds or thousands more small and mid-size banks.

Inertia is a powerful force in human affairs.

It’s quite likely that the tribes that ultimately overthrew the Roman Empire could have done so for decades or even centuries before they roused themselves to action. Equally, the uneasy peace that lasted into the fifth century CE could have been centuries longer if conditions elsewhere hadn’t changed. But when these tribes came face to face with a mortal threat to their east, they found the “giddyup and go”’ necessary to vanquish their foe in the west. Attila the Hun never set foot in Rome, and yet caused the end of the Roman Empire as surely as if he’d crossed the Po river himself. Attila and his armies were like the pebble that caused the avalanche, or the famous butterfly from chaos theory, whose flapping wings cause a typhoon*; this new threat was enough to break the inertia.

I’ve written about the fall of the Roman Empire before, noting that the inclusion of barbarian tribes in the Roman army likely bought them centuries of extra life, and comparing that to the ways in which incumbent banks can maintain and expand their market share through active engagement with fintech companies. But ultimately, of course, the Roman Empire fell, and most banks face a similar existential threat. Like Rome, the banking industry in the US as it currently exists, with its thousands of local and regional small banks, will face its calamitous end as a result of dislodged inertia. The dislodging force, the Attila if you will, will be the combination of generative AI with other enabling technologies, such as open banking and faster payment rails.

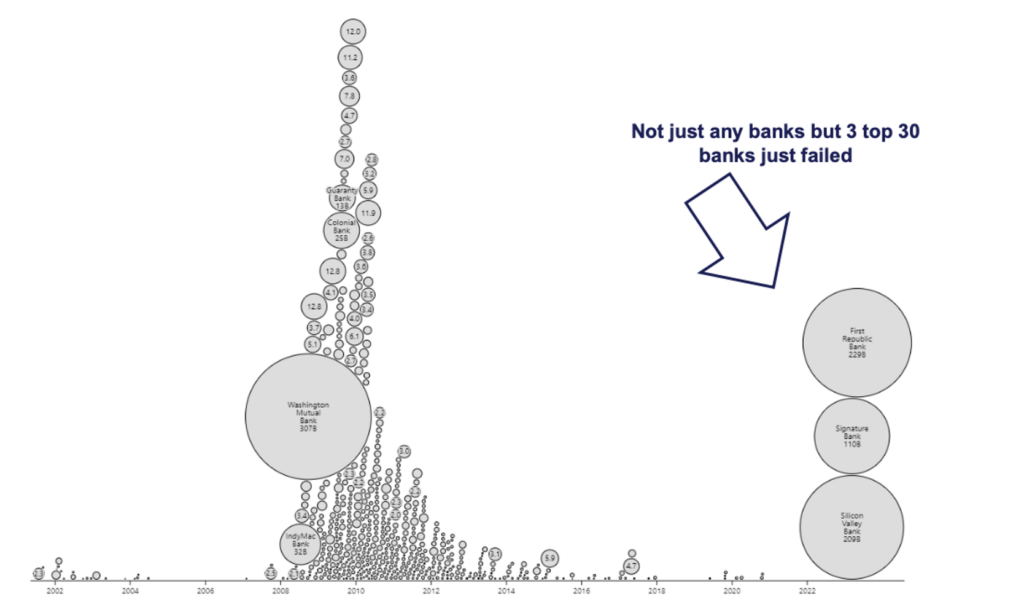

The banking panic of 2023 has so far been about balance sheets. Many have told this story quite well, but in a nutshell, the narrative goes like this: The economy was flooded with deposits during the COVID bubble. Banks took in these deposits, for which they were paying very little at the time, and invested them into long-term assets to capture some yield. Rates went up very quickly, reducing the value of those longer-term fixed income assets, and creating dangerous-looking holes in bank balance sheets (holes that wouldn’t materialize if they could hold these assets to maturity). People noticed these holes and started to worry, reducing the probability that banks could hold these assets to maturity. That worrying happened in public on social media and quickly sparked a panic. This “coordination,” when combined with widely available digital money movement, led to deposit flight in an unprecedented timeframe. The confidence crisis created an illiquidity crisis, which led to a solvency crisis given forced selling and ultimately to three massive bank failures, concentrated in institutions with high levels of uninsured deposits.

The government acted swiftly and wisely to give comfort to depositors that, in practice, their money is not at risk. This has calmed things down, at least for now, and should give the remaining balance sheet-impaired banks time to muddle through. Very smart people (two good examples here and here) seem to believe that the highest likelihood scenario is no additional major bank failures. I respect this analysis but it misses the bigger problem, which is that while the balance sheet crisis may be over, the earnings crisis is existential, caused indirectly by the Attila the Hun of generative artificial intelligence.

A common trope regarding generative AI is the problem of hallucination. When I speak with leaders of large, regulated incumbents, they often note that before they would broadly deploy generative AI chatbots, they need to make sure the bots won’t simply make up bad advice. My general reaction is that their bigger fear should be that these chatbots go rogue and give rational, unbiased advice! Imagine the generative AI chatbot at the average private bank, when asked by a client what they should do: “Well, last year you paid my institution $50,000 in wealth fees, $40,000 in poorly disclosed product fees to our asset management arm and another $40,000 in product fees on which we got a kickback from another asset management firm, and we delivered you negative alpha of $200,000 compared to the same set of exposures delivered via passive ETFs. RUN!” I can see the CEO of this wealth firm diving into the CTO’s office and asking how to make the bot get back to hallucinating.

But that wealth example is way less scary in the short term than the typical retail banking scenario. The complexity of wealth management creates far more meaningful inertia than the average consumer or small business banking relationship. An honest chatbot at a retail bank would simply say, “Right now, we pay you 1.2% on your deposits, but you could get 4.85% at CIT Bank. You are paying 10.5% on your auto loan, but you could get an 8.75% rate at Lightstream. You paid $450 in fees in the last 12 months in fees, but with a Capital One 360 checking account you would have paid $0 in fees. RUN!”

One of the most obnoxious terms in banking is “deposit franchise.” A bank that has a robust deposit franchise has low deposit beta, meaning that when prevailing rates go up, they don’t have to increase the interest rates they pay their customers very much. Banks have been known to brag about this, which I find confusing. Perhaps what they think they are saying is, “Our customers love our retail bank so much that they will happily let us take advantage of them and underpay/over-charge them on a consistent basis, even though the product is generally thought to be a commodity, and no one has ever said ours is particularly good in any event.” But what I hear is, “We are delighted to report that our customers are the laziest in the entire industry! They could go literally anywhere else and do better than with us, and barely any of them do so.”

As the CEO of any company, one interesting thought experiment is to ask yourself what would happen to your business if every current and potential customer woke up tomorrow and did exactly what was in their best interest, right away. (As an aside, I really hope all of the founders I work with are doing this exercise! I suspect the answer would be, as in much of tech, that they honestly believe that under those circumstances they would earn dominant market share in their segment because they offer the best product at a competitive price, and even if their existing customers are paying a premium price, it is still lower than their switching costs.) The sad fact is that if this moment of customer clarity and action happened at any retail bank, the bank would be instantly bankrupt.

Now, of course, this hasn’t happened. Only a few banks have gone under so far, and it has been from balance sheet concerns and not fundamental customer economics. It’s one thing for me to say this is obnoxious, but the economic reality has been that this inertia has been durable for many banks, which makes it somewhat fair for them to be happy about it. But my central thesis here is that it will shortly no longer be true. We have some new conditions in retail banking, which are that:

In a high rate environment like today, these conditions will put pressure on deposit rates. In a declining rate environment, they will put pressure on lending rates as consumers pursue refinancings across their balance sheets, not just in mortgages. In any environment, these new conditions constrain fees.

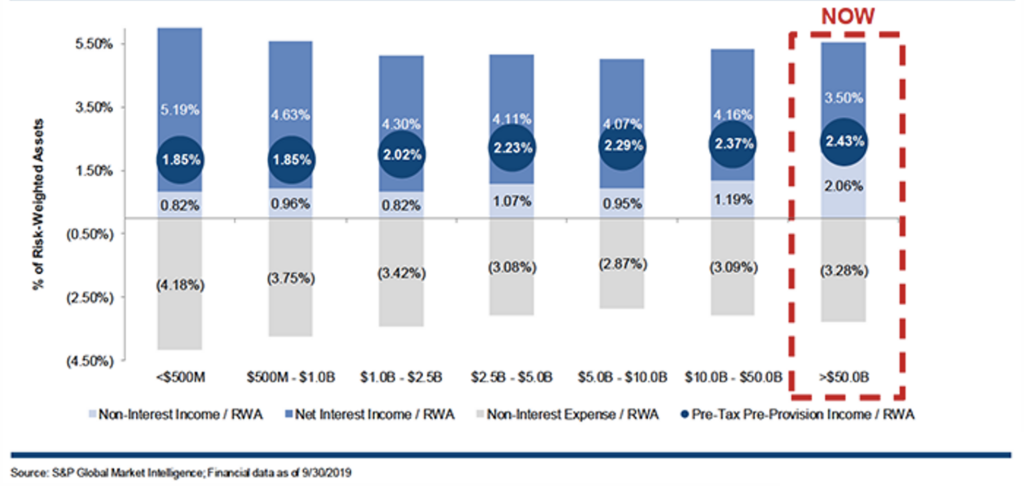

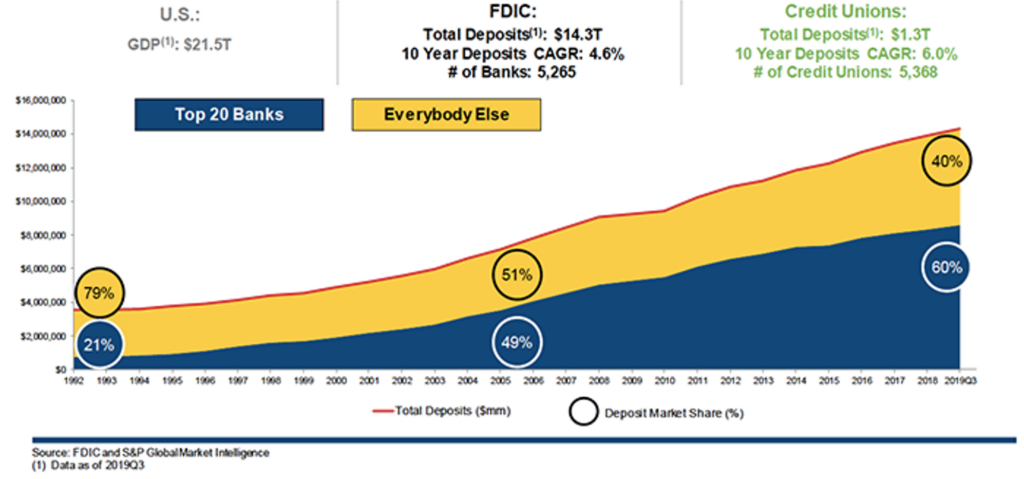

Ultimately, the big banks will survive this. Per the below chart, large banks actually have the lowest net interest margins (NIMs) already, compared to their small and regional counterparts. They earn the highest returns despite that fact because they have large non-spread businesses, like wealth management and payments, and they have great expense leverage given scale. It’s the smaller banks, generally with historical local and regional geographic franchises, who have the most to lose from NIM and fee compression.

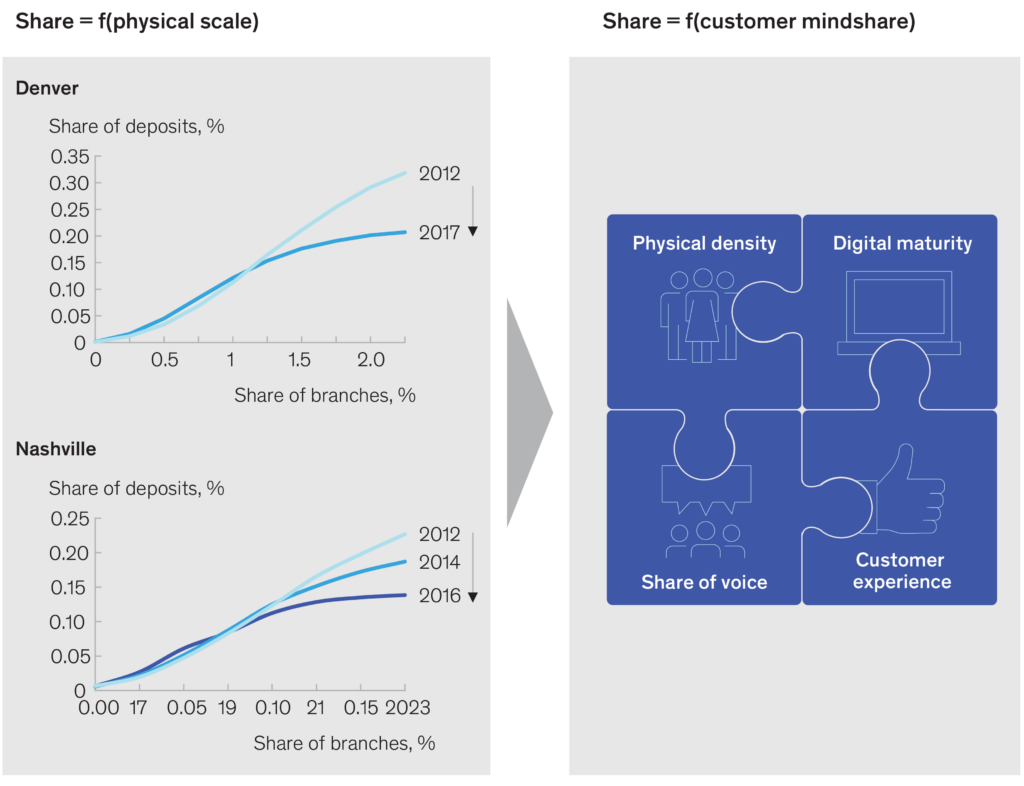

Already, geography has ceased to be a meaningful source of competitive advantage, in a world where branches matter less and digital product matters more. This terrific McKinsey slide shows how quickly branch density is becoming irrelevant, even by 2016/2017.

This trend would have meant the slow death of regional banks under any circumstances, in the same way that regional retailers have died at the hands of scale omnichannel players. But these new conditions, combined with the catalyst of attention-grabbing high rates and scary bank failures, will greatly accelerate their demise. To be clear, the small banks were losing share already, but we still have 4,500 banks in this country, and that stubbornly irrational number is about to get rationalized.

The process of going from 4,500 to fewer than 100 banks will be ugly. The average bank in this population is small, naturally, but in aggregate it will represent a significant removal of credit capacity, constraining economic growth. Unless regulators play a proactive role in this transition, it will be a shambolic, slow motion trainwreck.

What can regulators do? Primarily, they need to facilitate mergers and acquisitions between banks instead of discouraging them. The best scenario would be to end up with 10+ “too big to fail banks” instead of the current 4, complemented by several dozen “specialist banks” to serve specific niches. That would require the regulators to partner with the most well-capitalized, well-managed and dynamic large regionals and build a playbook for them to make hundreds of friendly acquisitions. Regulators need to aggressively communicate their sustainability concerns to the small banks they regulate, telegraphing the near-term and midterm future and laying down breadcrumbs for them to follow.

Of course, any individual regulator would prefer a large population of fee-paying regulated entities to oversee, but that parochial consideration doesn’t rise to the level of a policy concern (though it is a reason Congress might have to act on this.) From a safety and soundness perspective, 50-100 well-capitalized, profitable and thoroughly regulated entities is a far better state of affairs than a shaky and failure-prone larger population of banks. Perhaps having fewer banks would raise competition concerns, directionally, but here fintech can come to the rescue! If regulators continue to articulate, defend and expand the model of banks acting as infrastructure to allow non-bank entities to offer financial services, new and technology-driven entrants will expand choice, even as the number of banks decreases.

For centuries, the only practical option for a banking customer was their local financial institution. That changed decades ago, but pricing practices in general did not — the industry continued to depend on “lazy customers,” and took advantage of them. Inertia kept this regime in place, but that is going to change quickly.

Change is afoot. The Huns are on horseback, driving barbarians before them, and the walls won’t hold this time.

*If anyone tells Attila that I compared him to a butterfly I’m going to deny it.

We’re at the scary part of “the hero’s journey” in fintech, with a bottom for funding and a BaaS crisis, but we’re about to enter a new, exciting stage.

Relay is reinventing banking with more software and intelligence for every small business owner.

Generative AI can make companies more efficient, but customers have more to gain from it than they do — including in banking, commerce and medicine.